I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Update 12/1/22: Bask Bank Mileage Savings Accounts now offer 2 American AAdvantage® miles per $1 saved annually.

Update 5/1/23: The Bask Bank Mileage Savings Account now earns 2.5 Miles per $1 Saved Annually.

Update 11/1/24: The Bask Bank Mileage Savings account now earns 2 miles per $1 saved annually.

![]()

A Bask Savings Account is unique because it lets you earn large amounts of American Airlines AAdvantage® miles, and keep earning miles, without spending any money. You can move money in and out of your no fee account as you’d like.

And a Bask Savings Account makes a lot more sense than ever in the current environment, and especially because opening the no fee account before the end of April gives you access to bonus offers that will expiring. For instance you will earn 1000 miles at no cost just for completing online feedback by June 30, 2020 but you need to open your account by April 30, 2020 to be eligible for this.

Update: Bask Bank shares that they are extending the opportunity to earn bonuses:

A Message from Bask Bank: To help our customers navigate plans for the future, we’re extending the opportunity to participate in our Account Opening and Balance Bonus Offers.

We hope to continue providing customers with a more rewarding way to save and plan to extend the Balance Bonus for new accounts until June 30, 2020 as well as offer a new Account Opening Bonus from May 1 to June 30, 2020. Member FDIC.

See our special offers here: https://www.baskbank.com/special-offers

Earn Miles – And Act Now For Bonuses

Open a Bask Savings Account and earn 1000 miles in your American Airlines AAdvantage® mileage account for providing feedback by June 30, 2020. Open an account for yourself, and for family members too.

Once the usual rules on expiration of miles resume in August, it’ll be nice to have accounts for your family to easily keep miles from expiring, since a very small deposit puts a mile in your account each month.

That’s because you earn 1 mile per dollar saved annually. If you have a $60,000 average balance in the account you’re going to earn 60,000 miles for the year. Mileage-earning is paid out monthly so that’s about 5000 miles per month (months with 31 days in them will earn a few miles more, months with fewer days will earn a bit less). A $12 deposit earns an average of a mile per month.

There’s an initial deposit offer of 5000 AAdvantage® bonus miles for a $5000 deposit into the account held for 30 consecutive days within 60 days of account opening. This offer is valid for accounts opened March 1, 2020 through April 30, 2020.

You can also earn a large balance bonus provided you open the account this month and fund it within 60 days, and maintain the balance tier for 360 consecutive days from date of funding.

If you maintain a $25,000 balance for 360 days you earn 10,000 bonus miles; $50,000 balance for 360 days earns 20,000 bonus miles; $100,000 balance for 360 days earns 40,000 bonus miles. These bonuses are paid half after 180 days, and the other half after 360 days.

Why A Bask Savings Account Makes More Sense Now Than Ever Before

Like me, you’re probably grounded right now. I think it’s a good time to be saving up miles to travel once we’re able. And I love the ability to earn those miles without spending money right now. And in fact, a savings account is a more useful tool than normal, even when striving to hold onto cash.

When the Bask Savings Account first launched earlier this year I worked through the math and it offered a very attractive rate of return. Now, with interest rates hovering near zero, the ability to earn a return on frequent flyer miles is richer than anything else I’ve seen from a savings account.

Here are the 6 reasons I think a Bask Savings Account makes even more sense right now:

- Low interest rates make miles a better option. When Bask Bank introduced the Bask Savings Account, I did the math and found that the after-tax return was comparable to the highest yield savings accounts out there. Now the Federal Reserve has brought interest rates down to near-zero.

- A savings account is even more attractive now. In uncertain times I think it makes a lot of sense to hold cash, which is going to make a savings account more useful.

- Better award availability. I’ve argued that even once we’re traveling again it will take time for airline seats to fill back up. I believe that will mean better availability of award tickets at the lowest prices. In other words, I expect your miles to go farther than before.

- You’ve got time to save for the best trips that cost more miles. You’ll get the greatest return redeeming miles for international business and first class awards. Those cost more miles but also cost a lot more money. Use the time you aren’t redeeming miles to save up for the best rewards.

- Planning trips is a good part of the fun of travel. In fact research from the Netherlands finds that it’s planning and anticipating travel that drives the bulk of happiness from our trips. Earning miles with your account right now is part of that planning process. It helps make progress towards the mileage goal. It helps see what’s possible when we’re traveling again.

- You can earn miles right away if you open your account by April 30. You will earn 1000 miles just for completing online feedback by June 30, 2020. In my experience those miles posted just a couple of days after opening my account.

What’s more, I know I’m going to be working to rebuild my household balance sheet once this is all over. I’m going to be relying on frequent flyer miles to fund my travels even more than before, so that I can still travel and save cash at the same time.

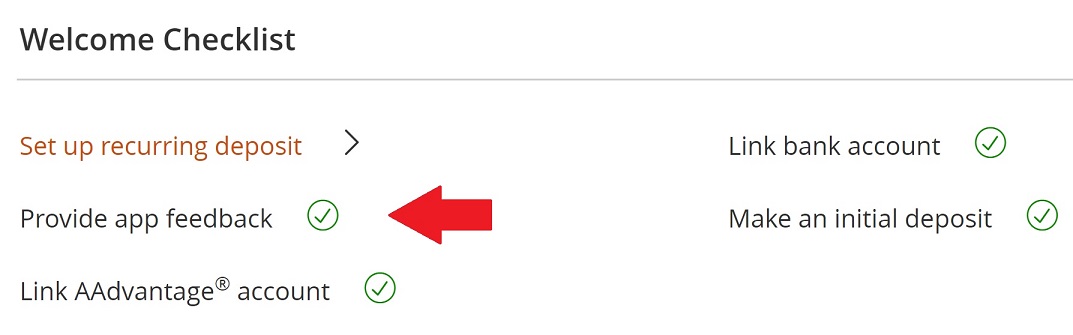

Screen shot, Bask Bank

Open A No Fee Bask Savings Account Before End Of The Month

Texas Capital Bank, N.A. launched the new Bask Bank offering online savings accounts that earn American Airlines AAdvantage® miles. I’ve been a customer of Texas Capital Bank since 2003, and I opened a Bask Savings Account too.

Opening an account is a good idea, and it’s most lucrative if you do it now because their current bonuses expire at the end of the month. In my view bonuses like these are too rich to bring back soon in a world of near-zero interest rates.

The 1000 mile feedback bonus offer, 5000 mile initial account funding bonus, and up to 40,000 mile large deposit bonus offer all require opening an account by April 30.

Saving now to plan for the future is how we’ll be able to travel again when we’re ready. A Bask Savings Account doesn’t have any fees, and the miles earned will help create experiences on a budget.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

Account Opening and Balance Bonus Awards valid through April 30, 2020. Accounts must be funded within 60 days of opening.

AAdvantage® bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6-8 weeks to post to your AAdvantage® account.

The value of this offer will be reported to the IRS and the recipient is responsible for any federal, state or local taxes on this offer.

How will the IRS value the miles earned when they issue a 1099 for the cash value of the miles earned at the end of the year?

@ What Charlie said, but I would word it, “What value will Bask Bank place on the miles when they issue the 1099′? If it’s the retail purchase price of the miles from AA, that would put a major dent in the value proposition of this promotion.

@Gary: The miles payout rate is lower than for a BankDirect checking account. Both are run by the same financial institution, Texas Capital Bank, it should be noted.

According to OMAAT, Bask’s valuation of miles on a 1099-INT is 0.42 cents per mile.

https://onemileatatime.com/bask-bank/#do_you_have_to_pay_taxes_on_miles_earned_with_bask_bank

@Mike as I’ve reported this comes straight out of their terms and conditions https://viewfromthewing.com/bask-bank-savings-account-earn-miles-for-saving-money/

No lol no no no

I opened an account about 3 months ago – I’ve received the bonus and the miles and they are great people to do business with.

@joel

Same here.

@L3, BankDirect charges $12/month fee for their AAdvantage accounts. Bask Bank currently has no such fee.

Just created an account for my wife. It was so much easier than about 10 years ago creating my BankDirect account via paper and fax. Yes, fax in 2009! This will be great since she’s been stuck at about 100K miles for years now and we need 115K for two saver business awards to Europe when and if we can fly to Europe again.

I’m waiting to see what the points will be worth after bankruptcy..

Yes an airline that devalued points even before this, not clear if they will even survive and I should accumulate miles with them why? (as opposed to the account where I get almost 2% interest albeit not FDIC insured)