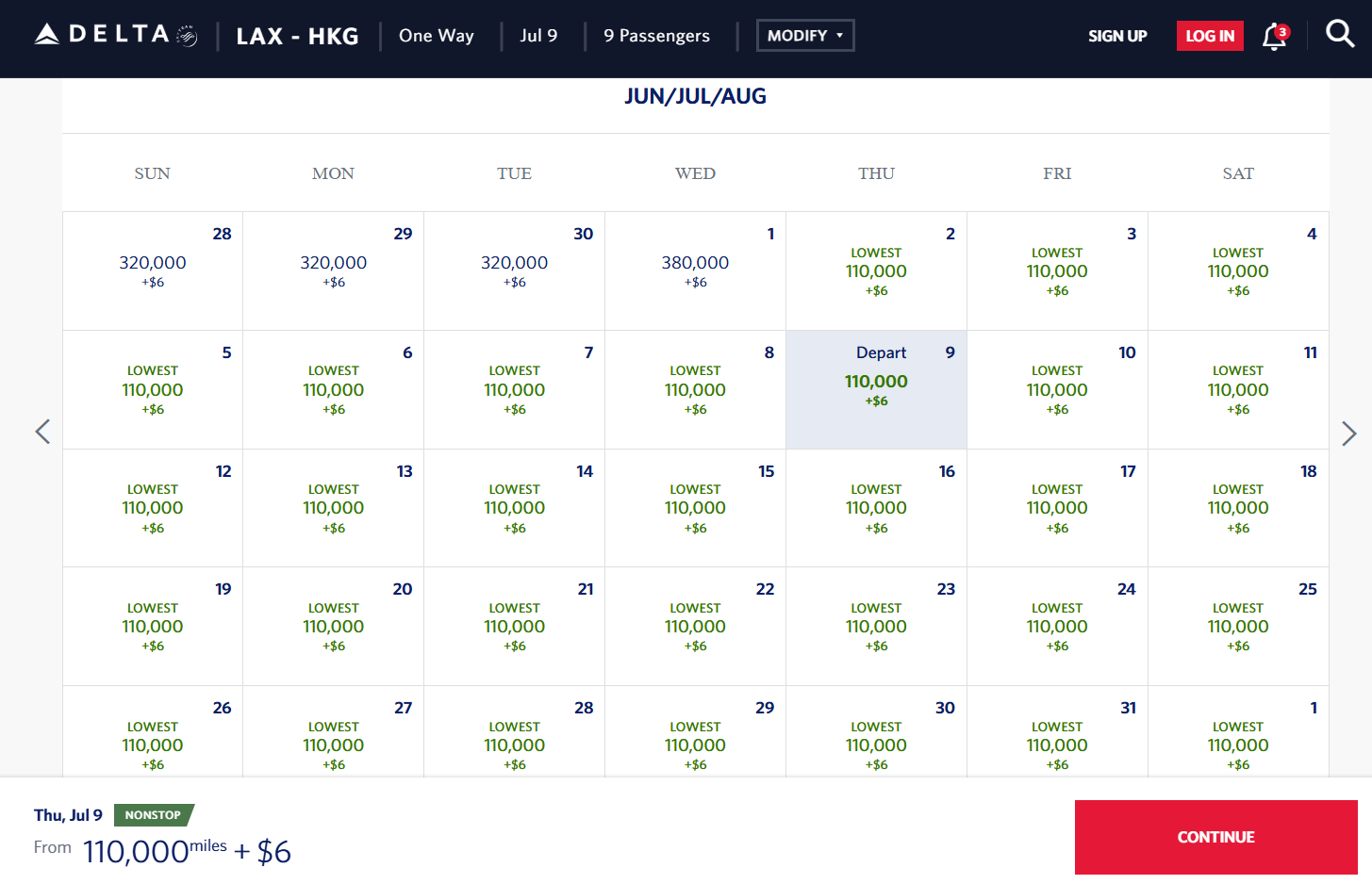

Delta Air Lines starts flying Los Angeles – Hong Kong again on June 6. It’s a competitive route, with both United and Cathay Pacific offering multiple flights per day, and they must not be expecting it to sell well. They’re making business class awards available at great prices.

- 110,000 Skymiles apiece for business class each direction

- 93,500 Skymiles for Delta Amex credit card customers

- 9+ award seats per flight, every flight

- Coach starts at just 14,400 miles each way per person

Wide-open availability on Delta One for as low as 93.5k miles on LAX-HKG

byu/omdongi indelta

This is available just about every day in July, August and September for at least 9 passengers per flight.

It is available in both directions when pricing as one-way trips. However, when I search as roundtrip the prices jump to a total of 350,000 miles.

This isn’t scream-worthy pricing compared to what many programs charge, but it’s amazing for Delta. Anything in long haul business class to and from the U.S. that isn’t twice that many miles is considered great. The only way to get a better deal is throwaway ticketing.

Getting 9 (or more) business class award seats at this price is actually phenomenal for any program. So if you want to get to Asia using Delta miles (or even American Express points) this is a good opportunity to use Hong Kong as a jumping off point.

just goes to show that DL is clearly doing well enough with SEA-TPE to make LAX-HKG its developmental project TPAC route.

Given the direct competition with UA and DL’s stated need to add routes that boost credit card and loyalty program value, DL is likely going to be very competitive on pricing to HKG which is not great news for UA which has about a 65% load factor on its 2 LAX-HKG flights.

DL is expected to carry at least 40k pounds of cargo per flight eastbound which the 359 can easily carry.

@Tim Dunn ummmmm how does this show that? SEA-TPE had only a 30% O&D percent rate as per the Taiwan airport authorities when they commemorated the route launch anniversary which almost always (esp. for Asia) portends low yields. Not to mention those who can see yield data have mentioned SEA-TPE for DL isn’t great and probably shouldn’t be flown / is overcapacity.

You can also find a fair bit of saver award availability for DL on that route.

lol. Only Tim Dunn could try to recast what is clearly a disaster of a route start into some kind of positive

Delta isn’t a charity, Tim. OneWorld has the best frequency and product on the route. United has far greater history, recognition, and loyalty in Southern California & HKG. It’s no surprise that Delta is entering the market in last place and now clearly showing it with a fare firesale 😉

@Tim Dunn says, just goes to show that DL is clearly doing well enough with SEA-TPE to make LAX-HKG its developmental project TPAC route.

To the contrary. Good deals (aka low prices or giving it away) are not a good sign from the airline’s POV. Doesn’t bode well for DL LAX TPAC as most experts predicted.

to all that bothered to comment,

DL clearly has the financial bandwidth to add more TPAC capacity regardless of whatever anyone thinks is wrong with SEA-TPE which is clearly a super competitive route.

DL is going into LAX-HKG w/ the intention of gaining traffic and winning over even more LAX flyers and doing it at UA’s expense.

UA’s 65% LF on LAX-HKG doesn’t bode well for the supposed strength of UA’s LAX TPAC operation – on top of the fact that UA cxld LAX-AKL and LAX-BNE when DL started those routes.

DL starts LAX-MEL shortly.

Must have been a fluke. I don’t see any of this. Lowest one way price next July I see is 272,000 miles.

DL’s SEA-TPE struggles against a lot of competition and better products on the other 3 operators in the market. The wide open availability on LAX-HKG is to stimulate traffic that clearly DL isn’t seeing. I predict both routes will be cut in 12-18 months. Yields are trash on a lot of Asia flying out of LAX, specifically for US carriers, who have middling products and indifferent service. UA makes it work, but it has a massive network across the Pacific that neither AA nor DL have.

Sure, but you commented: “DL is clearly doing well enough with SEA-TPE”. When Cranky mentioned the LTM LF data for UA’s LAX-HKG it was 67%. When he mentioned DL on SEA-TPE, it was 72%. Everyone who has access to yield data mentions that yields on SEA-TPE (like LAX-HKG for UA) are not good and the route is way overcapacity.

I would agree UA is almost certainly losing a good chunk of money on LAX-HKG, but with the same deduction DL is almost definitely on SEA-TPE as well – given LAX has higher yields than SEA to Asia, I would bet both are losing similar amounts of $. So how is DL clearly doing well enough on anything? They’re very likely doing just as well as UA on LAX-HKG which everyone deems a failure.

Does DL have a path to making those routes actually viable? The list of airlines that added such routes for “strategic flying” to Asia is very long particularly at LAX and includes DL at SEA as well. Every single time in ~5 years each airline has to retreat. So what is different this time?

Not sure if it’s a general development of the traffic or the tags to BKK and SGN, but seat maps on UA’s LAX-HKG show load factors way above the previous 65%.

DL, without the name recognition in HKG, with a history of going in and out (mostly out) of the market, and without any extra traffic to/from Thailand and Vietnam, DL will have a very hard time making this route work, as seen in these fire sale prices for mileage tickets.

It is no secret that every airline has developmental, lower margin flying. Given that DL has $1 billion profit advantage to UA – and even more to AA – and yet flies fewer system ASMs, DL clearly makes a lot more money overall.

DL has said that it is going to regrow its TPAC system which was honestly never in doubt. DL never said it was content to just be at parity w/ UA in Tokyo and Seoul combined and well behind them in the rest of Asia. There were a host of factors that had to come together for DL to decide to start regrowing its E. Asia network but those factors are clearly present after 8 years and DL is regrowing.

UA has an advantage to E. Asia from the west coast because of SFO but DL is clearly willing to fight for the LAX TPAC market – and believes there are a number of factors that favor it in at least getting to parity w/ UA and potentially growing far faster w/ larger and more capable A350-1000s to destinations that UA at best could fly w/ much smaller 787s.

LAX-HKG will be the most profile matchup between DL and UA in years – if ever.

and as is often the case, deep discounted seats don’t last long. the day before THX is a good day to keep people focused on air travel in the future.

Pretty miserable time of year to visit HK, tho. End of September might be OK.

Oh Tim, darlink… one simply must point out that Delta’s product on LAX–HKG is nothing short of tragic. Positively the worst offering on the route. It’s no wonder they’re practically giving the seats away—one might as well find them stuffed in a Tesco bargain bin.

And if this is what Delta calls the grand beginning of their Pacific expansion, then heavens… the airline is already destined for catastrophic failure. Truly, one fears you’re on the verge of becoming an even greater laughing stock than you already are, Tim. Quite an accomplishment, really.

If UA can get by with a 65% load factor with that high density Polaris product that is as yummy as a stuffed turkey, then DL should be able to garner at least 75% with a true DL One Suites product on its A350.

I’m so glad I am keeping you paid United chatboxes from leaving your cubicles in Willis Tower

Personally, I’d rather take Cathay nonstop JFK-HKG, but, that’s a good use of SkyPesos if you’re looking to burn them. Still, it’s +180K roundtrip.

@Tired — Ah, yes, lovely time for a typhoon, and if not, there’s the oppressive humidity and regime.

Looked it up and those are the worst months to travel to Hong Kong based on weather. No thanks.

Oh Tim, dearest, you of all people should know just how thoroughly English I am. Honestly, I’m practically steeped in Earl Grey at this point.

Yet even I cannot ignore your beloved Delta flogging LAX–HKG at discounts larger than a Boxing Day sale at Selfridges. Positively humiliating, darlink.

Honestly, Tim, one is left entirely flabbergasted. Watching you defend Delta at these rates is like witnessing a man try to joust on a unicycle—utterly foolish, painfully graceless, and somehow even more ridiculous than one dared imagine. One shudders to think how many people are quietly shaking their heads and wondering if you’ve misplaced your common sense somewhere between LAX and HKG.

nobody is defending DL; I do defend reality.

DL operated its much smaller TPAC system at a profit in the late 2010s while UA operated its much larger TPAC system than any other airline at just breakeven.

UA has been all about market share gains -and its financial performance in 3Q2025 proved how badly that strategy failed.

DL wants a piece of LAX international that UA owns; DL is clearly not backing down.

Passengers will benefit; UA will recoil to its enclave at SFO while DL will operate hubs at LAX and SEA.

It’s not hard for anyone with a modicum of intelligence to figure out.

keep tabs on this one, Gary

It’s simple. United is the big dog in USA to the Pacific/Asia and Delta wants a piece of the action. They tried with Portland Airport mini hub and NorthWest acquisition. It did not work. Delta is a very good airline, but in order to have parity (if ever) in the Pacific/Asia region with United they will have to spend/loose money like a drunken sailor on shore leave.

Will it work who knows.

Right now according to news reports United is gearing up for an even larger Pacific/Asia operation in the future.

So let the battle begin.

“DL wants a piece of LAX international that UA owns; DL is clearly not backing down ”

I love this

has tim finally admitted Delta doesn’t even bother to compete against AA and OneWorld.

How could they? Delta is a joke against AA/AS/OW on the West Coast on every metric anyone can imagine.

Thank you for FINALLY admitting it, Jackass

God

how long did it take you?

Fight against UA. Everyone knows it’s what DL is against. Everyone also knows OW owns this market and the West Coast.

Look at you admitting reality…

I’m shocked. Did you drink too much at Zocalos tonight?

Timmy

welcome to reality and delta’s position on the west coast: a LASTING lasting place. so good to see you finally here.

Yeah, what @ PinaLee said. How did Tim Dunce manage to hijack a post about a good fare and turn it into some twisted garbage about Delta’s profits? Their profits must not be looking too good on this route given the desperation pricing (for Delta, still extortionate for everyone else).

In Delta’ defense, the food on Polaris continues to be absolutely disgusting. Even the Tillamook ice cream used for sundaies is nasty. Maybe they should use Blue Bell? Then, I would have that for all three courses, thank you!

“nobody is defending DL; I do defend reality.” BAHAHAHA

I needed a good laugh, Tim. I ‘like’ Delta, too, but, c’mon, my dude.

Happy Thanksgiving, y’all.

For anyone interested – in Q2 – DLs TPE yields are the lowest LOH adjusted yields in any of DL/UAs TPAC flights.

UA: 7.7 cent yields, 80% LF, 8.8 cent PRASM.

DL: 7.8 cent yields, 81% LF, 6.3 cent PRASM.

UA had 2x as many flights as DL & 2.1x as many seats, while achieving the same LF, but UA still got 23% better yields. HKG is going to be an even worse bloodbath for them. I know UA is just chuckling.

PSC,

you will have to show your math if you think yields that are 0.1 cents apart and LFs that are 1 point apart result in a 2.5 cent difference in RASM.

Do you really proofread what you write?

And regardless of whatever number you think DL has on its worst TPAC system, DL clearly has the financial resources to start a very competitive route.

Let me run it past you one more time.

DL generated $1 billion more in profits through the 3rd quarter of 2025 than UA.

UA clearly is flying a whole lot of junk routes around whether you know what they are or not.

and Max,

you still can’t grasp that AS and CX are COMPETITORs to AA – not JV partners. DL on its own metal serves 4 cities on the S. Pacific from LAX, AA not so much. AA serves ONE city in E. Asia on its own metal from LAX.

Yes, Max, UA is who DL is gunning for.

DL will be the largest international carrier at LAX, taking the title from UA just as DL took the title as largest domestic airline at LAX from AA

Tim, lest we forget, no one *needs* to show their math, provide a source, or show you their 1040 for them to agree or disagree with your opinions. The commentariat is gonna commentariat regardless. That said, I like what DAL is doing at LAX. More, please. Oh, and ‘let them eat Biscoff!’

Tim, the difference between UA and DL profits continues to shrink, and this year’s $1 billion dollar difference includes a one time UA charge of over $500 million for the retro flight attendant payment.

So we’re talking about less then $500 million difference on revenues of approximately $45 billion each.

UA also has been bringing on hundreds of new planes over the last six years while still managing to decrease the difference.

UA also doesn’t have any fortress hub cities, unlike DL with four of them, and yet they’re still narrowing the financial gap each year. The underperformance in their coastal hubs and the west coast in general shows how strong their fortress hubs are, while also highlighting how difficult in can be for them in areas of intense competition.

DL’s TPAC yields dropped more than UA’s TPAC yields have this year, likely partially a result of the defensively run SEA-TPE route, hurt even more by the future LAX-HKG route.

You talk about DL’s powerhouse combination of Pacific hubs in SEA and LAX, yet DL didn’t even attempt HKG from SEA, and the combination of SEA and LAX is a tiny fraction of what UA has in SFO, before adding any of UA’s service from LAX.

You are so desperate for DL to become a percentage or two bigger than UA internationally in LAX, a hub NOBODY will ever truly win due to the intense competition there.

DL does a large amount of strategic flying. LAX to HKG for example, and the new European flights being added from SEA, clearly as a response to AS, even though airline execs state that European demand has reached its limit.

But strategic flying is fine for DL, especially since they only serve *4* cities in Asia. But call it what it is: strategic, a way to not fall even further behind UA, before there is no chance to catch up.

And no, subsidized flying to BNE and MEL doesn’t count either. Especially when UA has three flights to SYD, double daily to MEL, service to ADL, BNE, CHC, AKL, and PPT.

UA yield was 9.6 cents, DL yield was 7.8. Apologies!

mark,

so glad to see you came out of the woodwork

As for profits, UA underpaid its employees for years, took a charge for the FA’s retro payment in 2025 but still has not increased wages. In 2024, DL had the Crowdstrike meltdown which cost them a $500 meltdown so the two special charges cancel either one out.

UA’s profit 3Q year to date is $1 billion less than DL’s. They have come nowhere near closing the gap.

UA brought on a bunch of planes and dumped capacity into the market, delivering the worst RASM performance in the industry in 3Q2025; THAT is why UA’s profits lag DL’s so badly.

LAX-HKG is the same thing. UA was hellbent in not losing any capacity to HKG when Russian airspace closed so they shifted it all to the west coast. LAX-HKG is overcapacity as evidenced by their poor LFs. Cranky has done multiple articles on UA’s low LF int’l routes to other Pacific destinations which almost always resulted in schedule cuts – exactly what UA is doing now after their horrific 3Q print.

and whose fault is it that UA has no fortress hubs and dumps capacity into DEN and ORD in order to drive out its big 4 competitor and trashes its RASM in the process? The industry was deregulated for UA at the same time it was for DL (and AA). UA was fixated on international for years and merged with CO which had no domestic presence outside of its hubs.

Then UA has overscheduled up EWR multiple times with the final admission that the airport can’t handle the traffic UA has tried to schedule and declaring victory for the FAA imposing what UA could have done years ago even though DL still has slot controlled hubs at LGA and JFK. UA and UA alone is the reason for its disastrous domestic system and their incessant fighting against the reality of their decisions only makes their finances worse.

DL operates LAX-Tokyo and PVG in common along w/ SYD. DL has entered LAX-BNE and LAX-AKL and UA dropped them on its own metal. DL starts MEL shortly and SIN and/or MNL are certain with the 35K that will kick a 787 to the curb any day and twice on Sunday.

Yes, Mark, DL will keep growing at LAX; DL has the financial strength to pick out a route or two to develop while UA has thrown excess capacity into multiple routes – which is evidenced by their lower SYSTEM performance, and DL is willing to spend money to make sure that UA stays in SFO and DL is the largest int’l airline at LAX just as it is domestically.

This will be a fun couple years to watch as DL grows on the west coast and UA retreats to SFO.

It is certain that UA’s double daily LAX-HKG isn’t long for this world.

DL sees opportunity with LAX-HKG

This ‘deal’ was super short-lived; now, best offer is 144,500/way with discount, otherwise 170K.