Last week I wrote about checking your credit card statement for unauthorized hotel charges. A pet peeve of mine is hotels charging you for things not on your final folio.

I wrote,

When a hotel decides to charge you for something that wasn’t on your folio when you checked out, by just billing your credit card, they should have to email to let you know they are doing it and identify the item(s).

Oddly enough then I actually had a hotel email me last week about failing to charge me for a stay five months earlier. And it still struck me as a bit wrong.

Back in November I stayed at the Hyatt Place Chicago Downtown The Loop for one night on a Gold Passport cash and points reservation. They did not charge me for the cash portion of the award.

Standard Hyatt Place Room

I received this email from the hotel’s General Manager.

Dear Mr. Leff,

Thank you for choosing Hyatt Place Chicago/Downtown – The Loop. We appreciate your patronage!

We wanted to alert you of an upcoming charge from a past stay you had with us. As one of the newest Hyatt Place Hotels in Hyatt, it was brought to our attention that your stay in November for one night was never placed on your account / credit card from your Hyatt Gold Passport “Points-Plus Cash” reservation. We have worked diligently with many departments to rectify this issue and we wanted to inform you that these charges ($87.30 for 1-night) may take place within the next several business days. We do genuinely apologize for the lengthy delay and also feel it necessary you were informed.

If you have any questions or concerns please feel free to contact me.

Thank you for your understanding and patience,

I went back and verified and indeed they hadn’t charged me. It’s a lot easier for me to spot charges that have hit my card than notice when something hasn’t been charged. The GM was right.

I owed the money so I should pay the money.

However the amount of time represents a problem. Anyone submitting the expense to their employer for reimbursement might have been a problem — it wouldn’t be a timely submission. IRS accountable plan rules require submission within 60 days of incurring an expense. This was literally five months old.

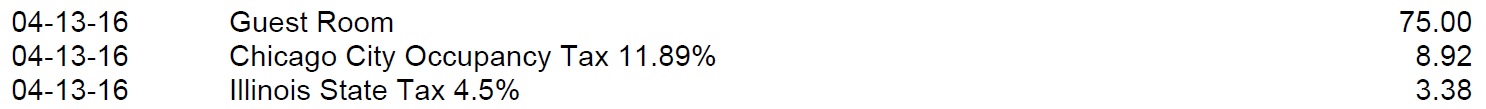

The hotel sent me a new folio detailing the charge:

And they charged my card.

And it got me thinking: how long is too long? How many months is too long after a stay for a hotel to say they forgot to charge you for part of your bill?

If it’s a valid charge, don’t really see what you’re complaining about. If you were expensing it to a company or the IRS, presumably the originally folio you got was the proof you needed to file that charge, not the credit card statement.

The biggest problem I see is that it was a tax deduction for LAST year. If you claim it this year and are audited, you’d have to explain it. It would also affect expense reports if they are done on a monthly basis for self employed people.

They should’ve just comped it rather than charge 5 months later

This post is upsetting. You provided a credit card at checkin. You entered into a contract with the understanding that you would be charged at checkout. They made the error, not you. As a Diamond member they should have just written the cash portion off. Or at the very least a few thousand GP points could have been issued in “good faith”.

—JRL

As long as the charge is legitimate I don’t really have an issue with late billing, even up to a year (after that, it is hard to remember and verify events). The worst offenders are car rental agencies, especially foreign companies. Most of these charges are bogus and then one is left to sort things out through the card company and the car agency. Most of the time late charges are bogus.

I had a hotel night that didn’t get charged until ~75 days later and my company tried to refuse to reimburse it stating the 60 day company policy (it might be 30 days actually). This leads to a very problematic situation.

Does Hyatt not have some time limit for customers to challenge billing errors in Hyatt’s favor? Seems to me the time periods should be consistent.

I’ve had this problem before at GH San Francisco, but it was only 40 days. It was on my work’s travel card, and so while it wasn’t a problem in this case, but if it were over 60 days it certainly would have been. In that case, I would imagine that someone from my company’s finance division should have had words with the hotel for being inept at their AR processes.

I had the same thing happening to me;

I had tickets on CX KUL.HKG.DOH.OSL

Changed the first leg to KA from BKI-HKG, in July 15

In January 16 I received the charge.

Motorcycle rental company Eagle Rider did this to me. Rented in early August, was not charged until mid January. It was an inconvenience as I was just starting my honeymoon but I checked my statements and it was a bill I was never charged for. I only wished they had called me prior so that I could of put it on a different credit card for a minimum spend.

I’m pretty diligent about where my $$ goes. 5 months after the product is consumed is beyond a deal breaker. I can’t believe they are even doing that.

60 or 90 days should be the latest they can charge you. You gave them all the info they needed to charge you at the time so they dropped the ball and should eat it.

Gary — I believe that the IRS accountable plan rule is that the expense must be submitted within 60 days of being paid or incurred (Treas. Reg. 1.62-2(g)(2)(I)). In your example, the 60-day period (which is just a safe harbor, not a formal legal requirement) would be met if the expense was submitted within 60 days of it being charged to the employee, even if the hotel did not charge the stay until months after it actually occurred.

@Storm do you know companies that will reimburse you in a manner that jeopardizes their accountable plan safe harbor?

Huge problem. If I was still employed by my old employer, accounting would never reimburse for this charge. As a freelancer, I bill my clients no more than 30 days after a job ends. I’d be hard pressed to send a client a bill for the room 6 months later and not look like a fool! Hyatt should have written this off as an internal error.

My first thought was – how long is acceptable if you found that they’d charged you double? Wouldn’t you expect them to reimburse you no matter the time frame? But the fact that they do know you’re a business traveler and the charge was from last year – I really would have expected them to just absorb this because it’s so problematic for the guest.

@Gary, what do I know, but here’s my thinking. We’re thinking of the wrong precipitating event and consequences:

1) A hotel doesn’t actually charge the employee. The expectation (and budget) assumes the accounting department/software will move the expected expense through its reimbursement process in a timely fashion (especially across a tax year). This is probably the most frustrating part of dealing with such a delay.

2) There not being an actual expense, however, an employee would be applying for a reimbursement that isn’t warranted. So I don’t think the company runs amok of the IRS 60-day safe harbor unless the employee improperly submitted a request for reimbursement…that then becomes the event in question.

3) So if an employee requests a reimbursement for something that hasn’t been charged, I believe the company is shielded if they fulfill the request. However, if the employee didn’t incur the expense, s/he would have to count that reimbursement as income, and then fix it when the hotel comes along 5 months later and charges the card.

So, what’s the limit? Well, I guess there isn’t one. I imagine if it gets more complicated if you have a new card number or have closed that account, so notification is a must!

I stayed at a Hilton property in the Caribbean in Feb 2015, at checkout they mistakingly had charged me for breakfast every day even though it was included in my rate. In removing it they also accidentally removed one of the 3 night room rates. I signed the bill and went on my way not noticing until I got to the airport. They didn’t notice for 9 months until they tried to charge my card and it got declined (the card had been replaced due to fraud elsewhere) so they took it upon themselves to call me to ask for new card details. In no uncertain words I told them to forget about it.

I think this episode brings up a different and larger question on integrity. If you know a company has not charged you for something you owe, should you say something? In the cases above, it may have been much easier to point out that you had not been charged.

On another note, Hertz once sent me a bill for fifty cents because they made an error adding the charges when I rented a car on Kauai during my honeymoon – I thought that was pretty petty way back then….

The relationship between hotel and guest is based upon a written contract, so, as long as the charge is correct based on the facts and contract, it should not be time-barred unless the legal statute of limitations on a written contract has run (2-4 years in most states), or the credit card clearinghouse rules has a shorter limitations period. This is consistent with the traditional general principle that a debtor is helped — not harmed — by a creditor’s delay in seeking payment of a valid debt.

There is no tax law complication. You are almost certainly a cash-basis taxpayer, not an accrual basis taxpayer, so the expense is deemed incurred when you actually pay it. A delay on the part of your vendor or supplier in billing you for services rendered does not affect the deductibility of the expense.

If the expense is reimbursable by an employer or client from whom you feel you can no longer obtain reimbursement as a practical or political matter, due to a termination or other change in the employer or client relationship, that is a logistical problem in YOUR contract relationship with YOUR employer or client, but that does NOT affect your legal obligation to the hotel. That being said, I think it likely the hotel GM would credit the charge if you could show that you were actually harmed by the delay.

Gary — Getting somewhat off topic, but my point is that the safe harbor is not jeopardized. The language of the Treasury regulation is unambiguous, the safe harbor is met if the expense is submitted within 60 days of the expense being paid OR incurred. In your example, the expense would meet the safe harbor if submitted within 60 days of it being charged to the card. The law is very clear on this point.

Getting even further off topic, for practical and legal reasons, employers will typically reimburse one-off expenses even if submitted outside of a designated submission window. There is more risk in denying the expense than in approving the expense. For example, California affirmatively requires employers to pay all reasonable employee expenses irrespective of the timeliness of the submission. An employer that refuses an expense on timeliness grounds faces liability that far exceeds the amount of the expense.

I’m having some ethical dilemmas on this one. My thought process is, and seems pretty typical for most people

1) Read the paid invoice thoroughly

2) Have the vendor address any over or under charges

3) submit my expense report with a correct receipt

If the charge was on the invoice but they actually didn’t charge your card then I might be able to understand some oversight, but if it were on the invoice then I’d have submitted that expense for reimbursement from my company. In that case I’m not out anything if they do charge me for the missed charge. If it weren’t on the invoice and I expensed it then I’m not ethical toward my company. If it’s not on the invoice and the vendor tries to charge me for it then there’s little proof they didn’t charge me or need to charge me in the first place. All of this is very fishy. If I’m trying to take advantage of my employer then shame on me and I deserve to foot the bill. If the vendor is trying to take advantage of me then contact customer service and cry foul, or complain to the card company and get a charge back issued…the vendor will HATE that.

Something’s rotten in Denmark…

They should eat this charge to be honest. It puts people in a situation where it can mess up their taxes or reimbursements. The delay in charging is clearly their fault and I would certainly call them up and complain. The room should be comped. Its not a matter of what you owe at this point. They waited five months and now it creates additional work for you in terms of records keeping and could potentially impact your taxes. I don’t see why you should be put in a worse position due to their incompetence. If this was a result of something you did to cause the delay then I wouldn’t have an issue with the charge.

Two things lacking here as far as the guest/customer is concerned:

1.Common Sense: you know you’ve incurred and expense, so there is a possibility of you getting the charge at somestage. If you need to reclaim from your employer/company to comply with accounting deadlines, then

2. Responsability: it’s up to you to chase the late invoice/bill.

Alright, the hotel (read any supplier) can make a mistake: preople are usually quick to pick up the phone/email when they have been over-charged, but oh so slow if never or under charged.

Subscriber Karen shrewdly ask the comp-monger chorus what their reaction would be if the guest discovered he’d been double-billed months after the fact?

Karen just as shrewdly predicted the comp-monger would expect the hotel to honor the contract and refund the duplicative charge, regardless of the passage of months!

Karen’s question and prediction underscore the fact that the obligations of contract are mutual and reciprocal — not a one-sided “Heads I Win; Tails you lose” proposition.

A person should expect to pay what the facts and the contract show they owe, and not a penny more — or a penny less.

A person should not expect a windfall to themselves, and a forfeiture by the hotel merely due to a billing delay.

“BANK ERROR IN YOUR FAVOR. COLLECT $200” only exists in the game of Monopoly; that’s not how the law actually works!

I was charged for a hotel room which was after 1.5 years! I was shocked by by credit card bill, so I called my credit card company and told them it was a mistake billing. I discovered an email explanation, about a week later. I never heard back, after I had reported them to the credit card company.

The hotel was correct to write to you explaining their oversight, but due to the time elapsed should have written it off, especially as it is a minor amount. This would have been a nice goodwill gesture which wouldn’t have affected their bottom line, and made you, the guest, feel well disposed towards the hotel (even if you felt they were a tad disorganized!). 30 days would be my limit in an uncomplicated transaction such as this to claw back any shortfall.

@Michael Feldman

Are you a first year law student who’s taken contracts but not studied consumer protection law at all? The kinds of contracts you enter into as a consumer with service providers are certainly not mutual and reciprocal in the same way that a negotiated contract between relatively equally positioned businesses are.

Dear Sam,

I guess I should have expected that it wouldn’t take long for some internet troll like you to begin hating on me with ad hominem invective.

No, I am not a first year law student. I have been a lawyer for almost 35 years, am admittted in two states, was a partner in the commercial litigation department of a prestigious downtown Los Angeles law firm prior to my retirement, graduated in the upper half of my class at a top 10 law school, graduated Magna Cum Laude from an Ivy League college, and have an IQ of 140.

If you would like to go back and re-read my comments, you will find that I clearly stated that, if the charge is supported by the facts and the contract, it is a valid charge. Therefore, If the monetary co-pay was mentioned in the registration documents, and there is a valid credit card authorization on file, both of which are indicated by what Gary wrote, then the hotel is legally entitled to charge for it, unless credit card clearinghouse rules impose a shorter limitations period than the time transpired. Although a case like this would obviously be unlikely to result in litigation, my legal analysis of the parties’ legal rights is correct. Your characterizations and opinions to the contrary do not substitute for what the contract says.

And what may I ask is your legal, scholarly, and intellectual background?

@michael Feldman, this is Sam 2. My iq is 175, I fly jet blue, I earn 4 million a year, Own six houses, and when apologizing without any reservations I invoke Muslim phobia and ptsd. I have also watched several law dramas on tv.

Last year I waited and waited for a huge baggage fee to hit my card so I could bill a client. When I say huge I mean thousands. Called the airline at least four times and spent endless hours on the phone; seriously like 8 hrs. They did not seem to care or have any knowledge, and said to just write it off. I just keep expecting that fee to pop up unexpectedly someday! So when comments are made about following up I just have to say, yeah right!

with 27+ years as a cpa you are all talking about safe harbor and the 60 day rule. You do realize that this ONLY applies IF the company is audited by the IRS in this area.

‘

Do you really think the IRS is going after T&E of this type? Not in my experience. They do not look at it for major companies at al. They only look at areas where they company says it is T&E and it is clearly NOT. Like taking a cruise with the wife and calling it a business trip. Flying to Hawaii for a conference on snow shoes!

The support for the business purpose is looked at FIRST before anything.

@Storm @Gary – I head up the expense reporting team for a large company that does a LOT of government work. We need to maintain Accountable status to continue receiving that work. As part of that we have to apply FAR compliance and DCAA audit standards to expense reports as well as vendor invoices.

We are able to put expenses on project budgets up to six months after the expense date, but anything submitted more than 60 days after the expense date (both project and overhead) must be treated as taxable income. We require itemized hotel bills (and meals receipts) when submitting expenses, as employees can charge items that aren’t reimbursable to their rooms as well as parking, meals, and etc. which need to be broken out from the lodging total. So this would have been caught immediately…it would have shown or not shown on the checkout bill.

The “taxable over 60 days old” is non-negotiable for us. The CFO has to approve not applying it.

The corporate overlords in the U.K. have a global policy that expenses not submitted within six months are not reimbursed at all. Exceptions are on a case-by-case basis and must be approved by (for us) the company president. A delayed bill from over six months previous would still require that approval, and may create issues if it was billable to a client project. Especially if the project is now closed. And it is still treated as taxable income.

This *specific* hotel bill would not have been an issue for us, as we don’t allow employees to use points/miles for work travel costs. But it could easily be a real headache for companies which do. (We do allow employees to credit to their loyalty programs and to keep those miles/points.)

Hyatt’s back-office systems didn’t work right???!! Be still my heart!

Quick answer is that while five months is too long, it is a legitimate debt, and I wouldn’t worry too much about it.

A longer comment is that in addition to Hyatt’s well-known system glitches and I T problems, my guess is that they are having trouble fully implementing the points-and-cash option in some localities, primarily Hyatt Place hotels.

I had a recent Hyatt Place incident that was equally inaccurate, though different from yours in that I did get charged. Specifically, the check-in clerk seemed to take a long time in pressing a bunch of keys after my rez came up on screen when I arrived, and then when I left I noticed that the charge was on there as a non-taxable package, and the folio specifically said non-eligible for GP credit. Took a bunch of consultation, but I got them to collect tax, and still didn’t get stay credit until I complained to the general manager and to Gold Passport at corporate.

At one point the Gold Passport ‘diamond’ rep said something like we really must improve our training with individual hotels and that I shouldn’t have had the problem. But she also admitted that it could have been a system glitch the way the points-and-cash reservation interfaced with that particular hotel’s computer.

I gathered from the general manager’s comment that points-and-cash was relatively new to her. That, plus the well-known glitch tendency of the chain tells me that points-and-cash is not bulletproof yet!

Ok, I’m not a lawyer but here’s my thinking:

-First of all, if it’s not obvious, it’s complicated.

-In this case it appears that billing was totally omitted rather than done in error. If Hyatt had screwed up and under-billed by $87 (say the bill was $287 and you were only billed $200…perhaps through the omission of a fee of some sort) then I’d argue it’s their problem after a given period of time. I suspect a vendor (hotel or otherwise) has a better case for a completely omitted bill versus one that was realistic but still in error.

–With that being said, there realistically should be a limit on how long they can wait to bill someone (in part or in whole), if for no other reason than all of the aforementioned possible/likely issues with passing billing on to someone else (e.g. expense reimbursement, client billing, etc.). At some point a company is likely to look askance at a late billing and/or it might practically not be possible to reclaim the expenses from an already-billed client.

How would I have handled your situation?

(1) If I was effectively unable to get an otherwise-owed reimbursement as a result of it, I’d likely initially refuse the charge noting that the hotel’s failure to charge me in a timely manner had effectively robbed me of that reimbursement. If the issue was with an employer, I’d probably offer some wiggle room to the effect of “You need to work this out with the guy who was supposed to reimburse me”; if it was with a client I’d say “You’re up the creek, I’m not sending my client a second bill over this”.

(2) If it was a personal trip or I could still get a reimbursement…generally, I’d probably respectfully insist on some sort of compensation for the relative hassle of a late billing, even if it was insisting on some points. This would be in part a move to “slap” them for the screw-up and encourage them to otherwise get their *ahem* stuff together. I might well escalate to Corporate over this.

(2b) The one exception is if it is at a specific hotel I value the services of (there are a few which are like this for me). This is really the only time I’d be inclined to eat the charge quietly, though if it was a lost-reimbursement situation I’d likely underline the issue to the manager all the same.

I had no idea that this is common. Yesterday I received a credit card bill on a card that I have not used in months. The transaction date was 1/24 for a hotel in Michigan, I live in Southern California. I immediately called the card company to dispute card and I was told to destroy card, they will reissue another card and also send info to the fraud department. When I got home, I Googled the hotel and recall staying there one night EIGHT months ago. Hell, I can’t remember an hour ago let alone 8 months ago. As a potential hoarder, I now don’t hold on to every bit of paperwork once I check it over and pay the bill. Yes I realize that it may be a legitimate charge but it certainly is an inconvenience to get an unexpected $152.00 bill, especially now that I am retired and have suddenly gotten hit with $8,000.00 out of pocket medical bills this past month. I am hoping Hilton comps me for their lack of billing in a timely manner.

My thought is if you haven’t been charged within 30 days the Hotel should write it off. I recently went to Vegas and charged my meals out to my room. I paid my Bill in full expecting my last night of stay dinner to be changed within a day or two and it was. However, more than 30-days after my check out I received two more charges to my account from the resort with no specific description of what the charges were for. I tried for a week to contact them and sent them 4 faxes (on 4 consecutive days) requesting an explanation for the charges but never received a reply, and could not reach a human on the phone. So I reported the charges to my CC company and requested that they send me a new card. Another 20 days go by and I receive a VM from the Mirage saying the charges were for room service (I never ordered room service), and that they had a mix up in accounting that’s why it took so long to charge me. They are adamant that I am responsible for the charges, and I disagree. It is so frustrating that I have had to spend so much time on researching this. BTW I tried calling them back in response to their VM, but again only get a phone tree and no live person.

Well at least you received an advanced notice of the charges. Stayed at a hotel in July of this year and could have sworn I saw a pending charge come through our account, so I didn’t pay much attention after that. Three months later (yesterday), I see a charge for $258. That’s quite a hefty charge to push through with no advanced notification to the customer.

What if the major-branded hotel emailed you six weeks after your departure saying it didn’t have your credit card and you still owe half the amount of your stay?