If you have a lot of money sitting around, or investment assets, you can earn miles. Basically just about anyone will reward you with miles for your business and when a lot of money involved so are a lot of miles.

Here are three ways your money can work for your mileage balances.

Up to 100,000 Miles in Each of 3 Different Programs for Fidelity Investments

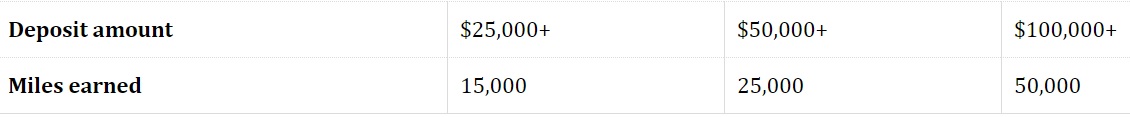

I used to use Sharebuilder for opening account bonuses, but in recent times the biggest miles have come from Fidelity. Like 50,000 miles for a $100,000 deposit.

Plenty of folks have earned more than one bonus from Fidelity for opening and funding an account — miles with American, United, and Delta. In fact you can earn one bonus per 12 months.

You used to be able to game Fidelity’s deposit requirements but they’ve since closed that loophole.

Still, if you need an investment account anyway and have cash or investments in your portfolio, you can pocket plenty of miles for letting them sit in a Fidelity account.

Here’s the earning table:

Miles Every Month for Your Checking Account

I’ve used Bankdirect as my primary checking account since July 2003. They give me 100 miles for each $1000 of average balance each and every month, and there are signup bonuses as well.

In a low interest rate environment this is a pretty good return, especially since there’s no tax reporting on the miles but you’d pay tax on interest earned (such as it is these days, on a checking account).

Copyright: micchaelpuche / 123RF Stock Photo

They now cap mileage-earning based on a $50,000 balance, but that’s still 5000 miles per month if you max out (at a monthly fee for the checking account of $12). And you can earn up to 21,000 bonus American AAdvantage miles for a new account.

Now Earn Up to 100,000 United Miles for Investing Through Lending Club

Lending Club has given United miles, American miles, and US Airways miles for borrowing money.

They now have a big offer for investing your money.

It’s one mile per $2 invested by new customers. You earn better yields than a bank, but there’s some risk. (They claim ‘low risk’ and 5% – 8% returns.) Diversify your portfolio with them and reduce risk, but if the company itself doesn’t make it these aren’t insured investment accounts the way your brokerage account would be. I think a good short summary comes from Centurion on Flyertalk.

I can find nothing in the T&Cs that tell us whether or not the value of the miles will be taxable.

I’m going to go ahead and say that my personal experience with Lending Club was that the returns were relatively meager and IMHO the risk adjusted return was not worth it. I was pretty conservative with my investment criteria and the “low risk loans” in the 5-8% range left, after defaults and expenses, still left only 2-3% gains. YMMV of course.

Yeah, but the mile bonuses haven’t doubled to off-set the devaluations; hence, it’s now 50% less than the previous return from a year to seven months ago.

I’m not understanding the heading, “Up to 100,000 miles…Fidelity Investments”.

It looks to me like the maximum is 50,000 miles for a $100,000 investment, right?

I like the idea of the Bankdirect 6 month CDs for American miles. You end up with the same total miles as you would with Fidelity, you only have to commit to 6 month CDs, no fees (better than the Bankdirect checking). My math is 2 $50,000 6 month CDs get 25,000 miles. Am I missing something?

I cannot comment on the other options, but retail brokerage (like Fidelity) is a much higher cost of doing business than alternatives if you’re in that neighborhood of money. Robinhood is free stock trades and think same on most “fees” (transferring cash out anyway) being 0. Would say Interactive Brokers’s platform is if you have substantially more than 100 grand, but again they’re probably better only if you intend on borrowing (margin account) to help finance trades but that is inherently a riskier strategy and are meant for “professional” investors.

Fidelity definitely is among the costlier options, but can always do worse!

Re: Lending Club

If you bother to read the prospectus, as most people fail to do, you are not really investing in individual loans. You are investing in unsecured debt of Lending Club.

@Als Bankdirect checking returns 5,000 miles per month on a $50,000 balance. The monthly fee is $12. So as a comparison to the the 6 month CD, $50,000 returns 30,000 miles and costs $72 over the same time period.

Every six months, $72 in fees buy you 5,000 more miles, which comes out to 1.44 cents per mile. To me, that’s worth it, but everyone has their own valuation.

My husband and I each put $100k in Fidelity, for the 50k miles each. The problem with Fidelity is there’s no easy way to get a decent interest while your money is parked there. So to avoid getting nothing, we bought 9 month CD’s at 0.65% (they are a bit higher now). Since it would have earned 1% in my savings account, it cost us $357 after taxes. $357 for 100k miles = $0.357/mile, which is quite a good price since we typically redeem for $3/mile.

“It’s one mile per $2 invested by new customers. You earn better yields than a bank, but there’s some risk. (They claim ‘low risk’ and 5% – 8% returns.) Diversify your portfolio with them and reduce risk, but if the company itself doesn’t make it these aren’t insured investment accounts the way your brokerage account would be. I think a good short summary comes from Centurion on Flyertalk.”

15 years old article. Returns updated since then. Plus some news.