These two special offers expire tomorrow — May 4 — there’s just one day left.

Key links:

- Hilton HHonorsTM Surpass® Card from American Express: 100,000 Hilton HHonors points after $3000 in purchases on the card within your first 3 months of cardmembership. (offer expired)

- Hilton HHonorsTM Card from American Express is the no annual fee version and is offering 75,000 Hilton HHonors points after $1,000 in eligible purchases on the card in your first 3 months of cardmembership. (offer expired)

American Express has its biggest-ever signup bonuses for its two Hilton HHonors credit cards and is running them through May 4.

Hilton HHonorsTM Surpass® Card from American Express: 100,000 Hilton HHonors points after $3000 in purchases on the card within your first 3 months of cardmembership. (offer expired)

The $75 annual fee card comes with Hilton HHonors Gold status which means 25% bonus on points earned through Hilton stays, room upgrades where available, and breakfast or lounge access as an option at most Hilton properties. It’s a lower annual fee than the $95 Citi Hilton HHonors Reserve Card which also comes with Gold status. ($40,000 worth of spending on the card in a calendar year earns Diamond status through the end of the next year.)

You also get a Priority Pass Select card for lounge access (this version doesn’t include free guests or free visits)

Points-earning is 12 HHonors points per dollar on Hilton purchases, 6 per dollar at U.S. restaurants, US supermarkets, and US gas stations, and 3 points per dollar on all other eligible purchases.

Hilton HHonorsTM Card from American Express is the no annual fee version and is offering 75,000 Hilton HHonors points after $1,000 in eligible purchases on the card in your first 3 months of cardmembership. (offer expired)

The card earns 7 HHonors points per dollar on Hilton purchases, 5 points per dollar at U.S. restaurants, US supermarkets, and US gas stations, and 3 points per dollar on all other eligible purchases.

View from the Hilton in Colombo, Sri Lanka

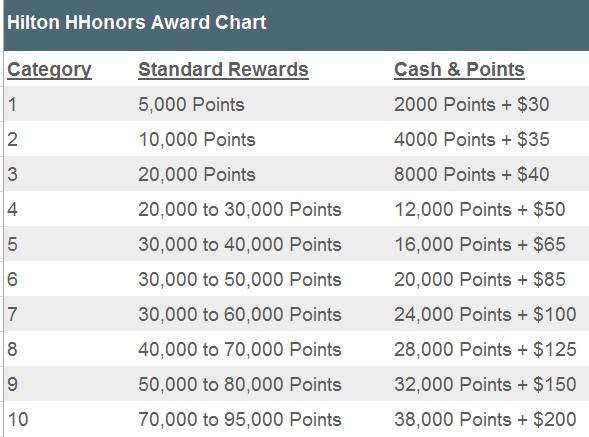

Here’s Hilton’s room night redemption chart:

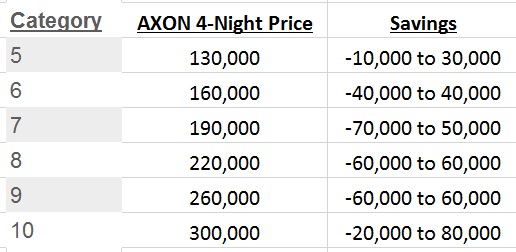

AXON Awards: American Express co-brand cardholders can book ‘AXON’ awards which are discounted awards for four night stays in category 5 through 10 hotels.

Savings are fantastic when reward nights are at the high end of the range for a hotel’s category. They’re not good when a hotel is at the cheapest end of the range.

5th Night Free: Hilton HHonors elite members receive every 5th night free on Standard Room Rewards (up to four free nights on a stay of 20 consecutive nights). It’s not technically night 5 that is free, however.

If you’re booking a stay that’s longer than 5 nights, and some nights require more points than others, you should break up the reservation and use points for the 5 consecutive nights with the highest points price.

On the other hand if you book the full stay in one reservation, Hilton totals the number of points for the stay, averages them, and deducts one night’s worth. But if you book the five highest points nights as one redemption you will maximize the 5th night free.

Leveraging the Low Categories: Hilton offers more value than any other program for low category redemptions.

While Hilton’s top hotels aren’t as pricey in points (adjusting for inflated currencies) as Starwood’s, and while the Conrad Maldives, Conrad Koh Samui, and Hilton Bora Bora are super-desireable (I’ve been to the Koh Samui hotel and to the Hilton Bora Bora when it was part of Starwood), your points go the farthest for the outlier low category properties.

My award booking partner Steve shared his stay at the Hilton Salalah Resort in Oman which is a category 1 hotel.

Beach is over 2 miles long and about 75-100 yards wide. Absolutely empty even though hotel is full.

If you look to the left on beach there is nothing but sea (to the right is a monstrous port with about 20 cranes.. intriguing looking). The service is great.

The property is definitely not cutting edge but surely not shabby. More than acceptable especially for 5000 points per night. The room is perfectly fine… Food on property is more than fine…

Hotel is a few kilometers from town but a couple of restaurants within walking distance. There are no other hotels on the beach within sight. So take that sense of isolation for what it’s worth to you.

Between all my family Hilton HHonors credit card sign up bonuses we have about 130 category 1 free nights. So it was worth checking this place out firsthand. It is consistent with most tripadvisor reviews.

Is salalah worth staying for about a third of a year?? The math of 130 free rooms is pretty compelling for what most folks would judge this a solid 3.5 to 4 star property.

The hotel is 15 min from center of town. The town is compact and clean and a clutch of pedestrian friendly side streets with relatively genetic shopping offerings and a bunch of crazy inexpensive and delicious Indian Chinese and Arabic restaurants.

The hotel dinner offerings include an outdoor seaside restaurant that was quite good.

As Salalah is not actually on the American traveller bullseye. The locals are both fascinated and thrilled to have us. Expect exemplary if not fawning treatment.

You can certainly stretch your 5000 point per night redemptions with Hilton HHonors!

Can I apply for both on the same day? I usually wait a week but the offer is expiring tomorrow!

Yes, here’s a recent data point: http://www.flyertalk.com/forum/26570691-post89.html

Appreciate you sharing these links with everyone..I almost forgot this is the end of this GREAT deal. With that in mind, if a few of you folks could help out a fellow reader, that would be great…thank you 🙂

https://www.americanexpress.com/us/credit-cards/personal-card-application/hilton-hhonors-credit-card/100073-750-0?om_rid=NsgTk8&om_mid=_BXJX9AB9CkuipD&om_lid=axp11

if we already have the regular Honors Amex, can we still apply for the Surpass Honors Amex?

@tim — Based on my experience, I believe that if you already have the no-fee HH AMEX and you are approved for the HH AMEX Surpass, they will upgrade you to the Surpass, you will get the sign up bonus and, importantly, your account number will remain the same as it was for the no-fee card. That’s what happened to me a few years back when the sign up bonus for the Surpass was 50K MR points and I applied for it while already in possession of the no-fee card. It is an upgrade but you still get the bonus points, and you’ll see no differences in your online account…

BTW, because the same account number is kept when the no-fee HH AMEX is upgraded to the Surpass, the “member since” date and the age of the associated credit history remain the same as those of the no-fee card, avoiding a potential hit to the length of one’s overall credit history, which, if it decreases, can decrease one’s credit score…

Your FICO score continues to calculate average age of accounts including cancelled cards under those cards age off the report years into the future. This is a small piece of your credit score in any case.

@Gary: “Your FICO score continues to calculate average age of accounts including cancelled cards under those cards age off the report years into the future”

This is just one data point but when I added my HHonors Citi Reserve Visa, which was my last acquisition, my FICO score went down a bit, and, according Credit Karma, the factor that did it was that the mean age of my credit history decrease by adding a new card. Then, after I canceled the same card about a year later, I noticed a bump in my FICO score, and the reason again was causal: canceling the newest card in my wallet increased the age of my credit history.

I am not saying that your claim is wrong because I do not know one way or the other what you based it on. My observation is real. It could simply be a difference in how the different credit bureaus implement the FICO model. Credit Karma uses TransUnion.

Aha! Here it is, from credit Karma: ” We calculated your age of credit history by averaging the ages of your OPEN credit accounts.” [cap letter mine for emphasis].

@DCS applying for a new card is a different issue than canceling a card. Don’t take the explanatory algorithms from Credit Karma too literally.

@Gary — It is not a matter of taking the “explanatory algorithm” too literally. It is a matter of actually seeing my credit score go down and then up, respectively, with the addition and cancellation of the same card…

What I would agree with is that the age of one’s credit history is but a small piece of one’s credit score, with a “medium impact” on it, according to Credit Karma/TransUnion…

@DCS and as I said, FICO (but not Vantage) continue to calculate average age INCLUDING CARDS YOU CANCEL until those cards age off your report. Cancelling a card does not have an impact on your traditional FICO score average age for quite some time.

When you apply for a card that both means a hard pull on your credit, and a new card will have some effect on average age depending on number of accounts, both of which have an impact on score. Both are temporary — the hard pull effect goes away quite quickly, the average age effect of course goes away as the account gets older.

@Gary — We are now going in circles. My observation was with with FICO, before CM/TU started using Vantage — a more sensible model, in my view. It is probably a mistake to think of FICO as a fixed model that fits all. It is purposely malleable so that different bureaus and lenders can choose to emphasize and how they interpret different factors within the model, a caveat that is usually issued with credit reports…

G’day!

I’m not going in circles, my explanations are consistent. Your comments on the other hand are more zig zaggy than circular. 😉

Now that Gary has gone personal, and considering that he profits from us signing up for the card in the first place, I say DCS is correct.

A bit off topic, Gary with Chase limits on all cards I can get one. Would it be this Hilton with 100k pts, Marriott with the 80k+, or the Hyatt with two free nights sign up bonus?

@Gary not enough info about your rewards goals and what you already have to advise on best product for you

I have CSP SPG Deltagold Hilton Honors (old) SWA Discoverit

@Gary — You can claim “victory” if you wish. I cannot possibly convince someone who believes that empirical evidence is relative. I observed what I said I observed; I produced the statement from the credit bureau’s “surrogate” supporting what I had observed. I have tried making the point the “FICO” model is not fixed, and that different implementations are more the rule than the exception. None of it seems to any sense to you (I actually suspect that it does but the “Thought Leader” must never concede anything!). So, sure. Go ahead and claim victory. After all, these are the sort of things that each person needs to find out what works for them…

@tim — 😉