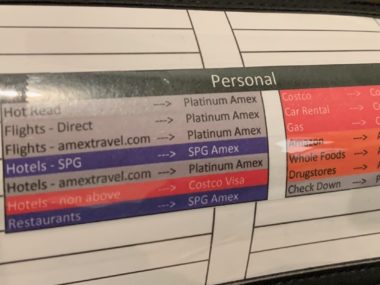

I recently shared what’s in my wallet and I clearly use a lot of different cards for different purposes in different situations.

Keeping a strategy straight for yourself can be hard enough, but how do you make sure your spouse — who isn’t as attuned to these things as you are — uses the right card every time?