I’ve known that Citibank was working on a refresh of its American AAdvantage small business card, but we finally have some concrete sense of what they’re thinking.

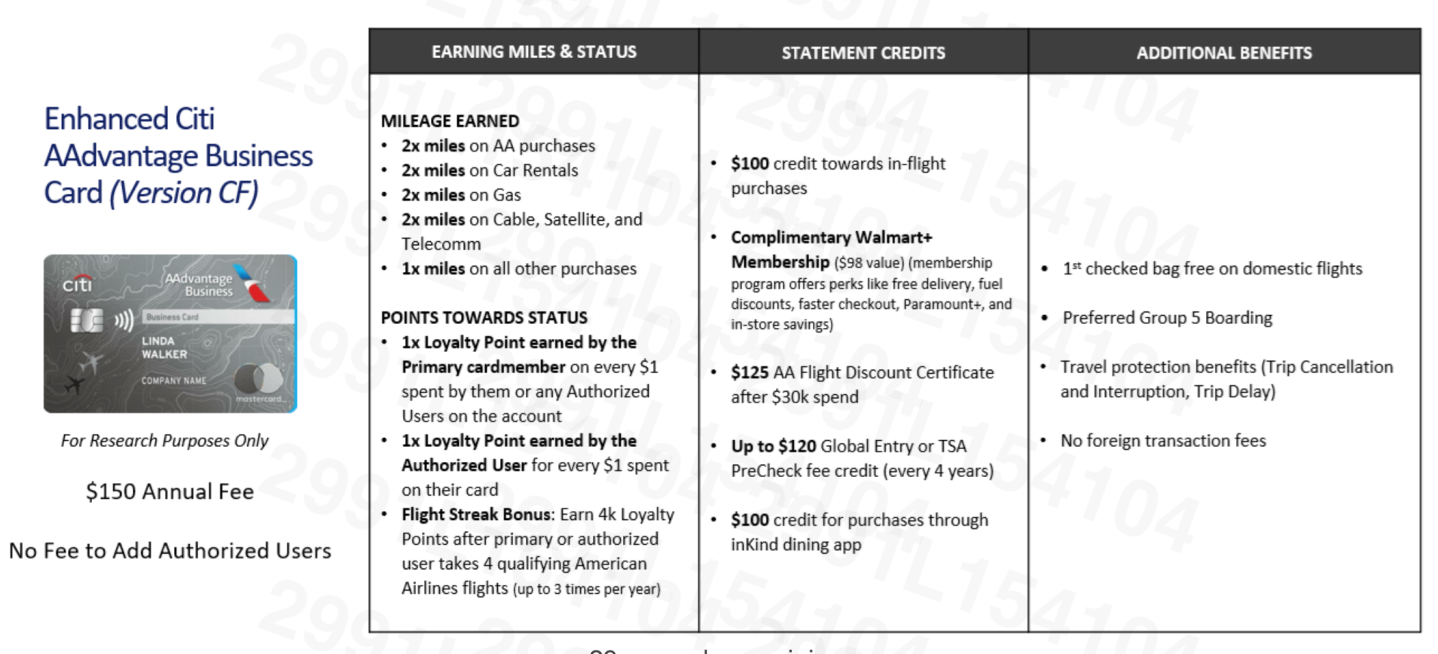

Here’s a product being surveyed by Citibank as a refresh of their American AAdvantage small business card. This may not be the final card they come up with, although I’d note that when they surveyed a refresh of their premium AAdvantage Executive card the survey I wrote about was very close to what was ultimately offered.

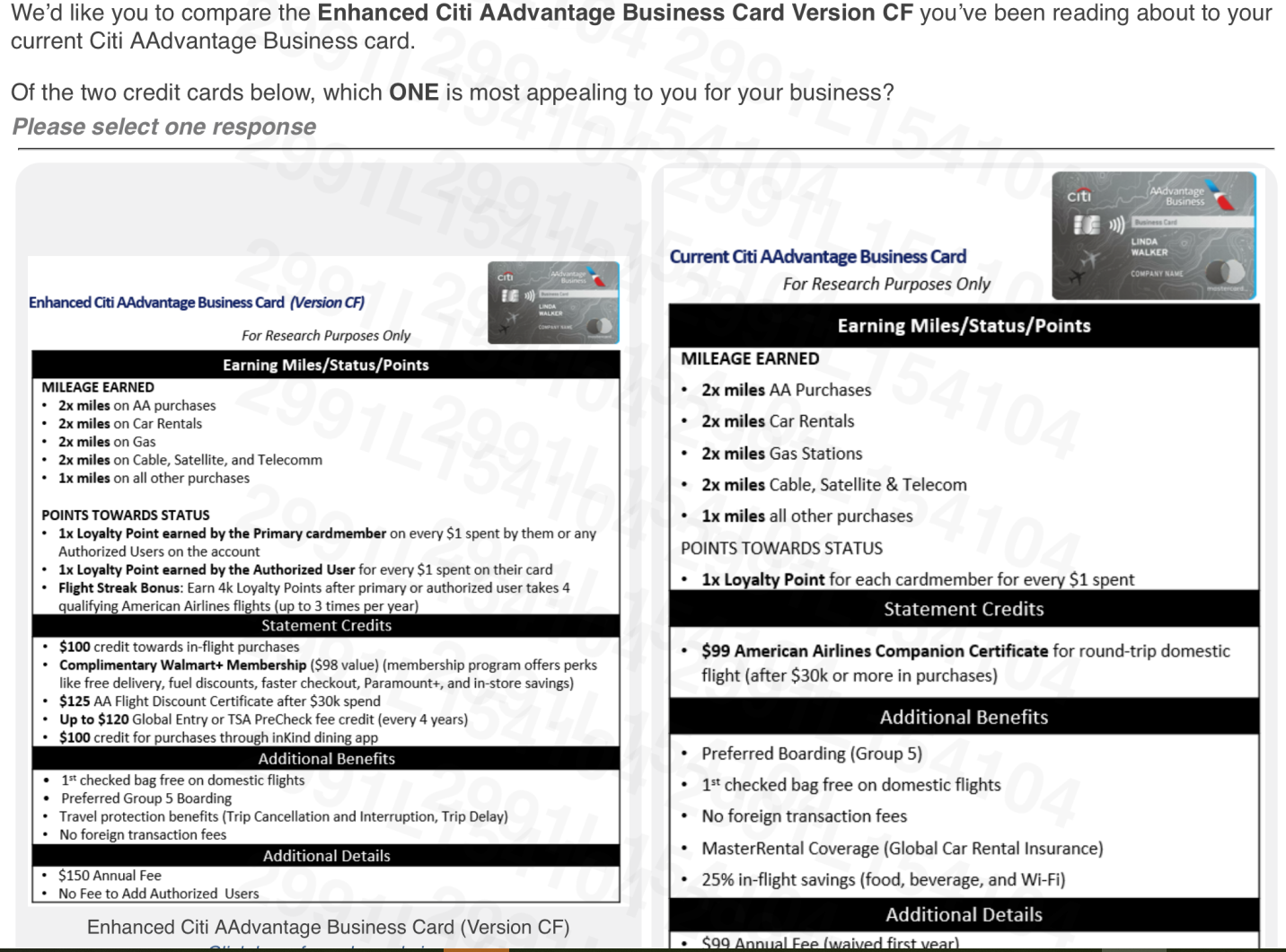

The thinking here is a $150 annual fee card (vs. the current $99), positioned along the same “$150 business mid-tier” lane as the United and Delta cards, where the marketing story is “fee is offset by credits.”

It replaces the current $30,000 spend benefit of a $99 companion certificate with a flight discount certificate. In the survey they A/B test the discount amount ($125 / $200). The companion certificate has high upside if you use it well, but restrictions are annoying. The discount has a smaller upside but is simpler.

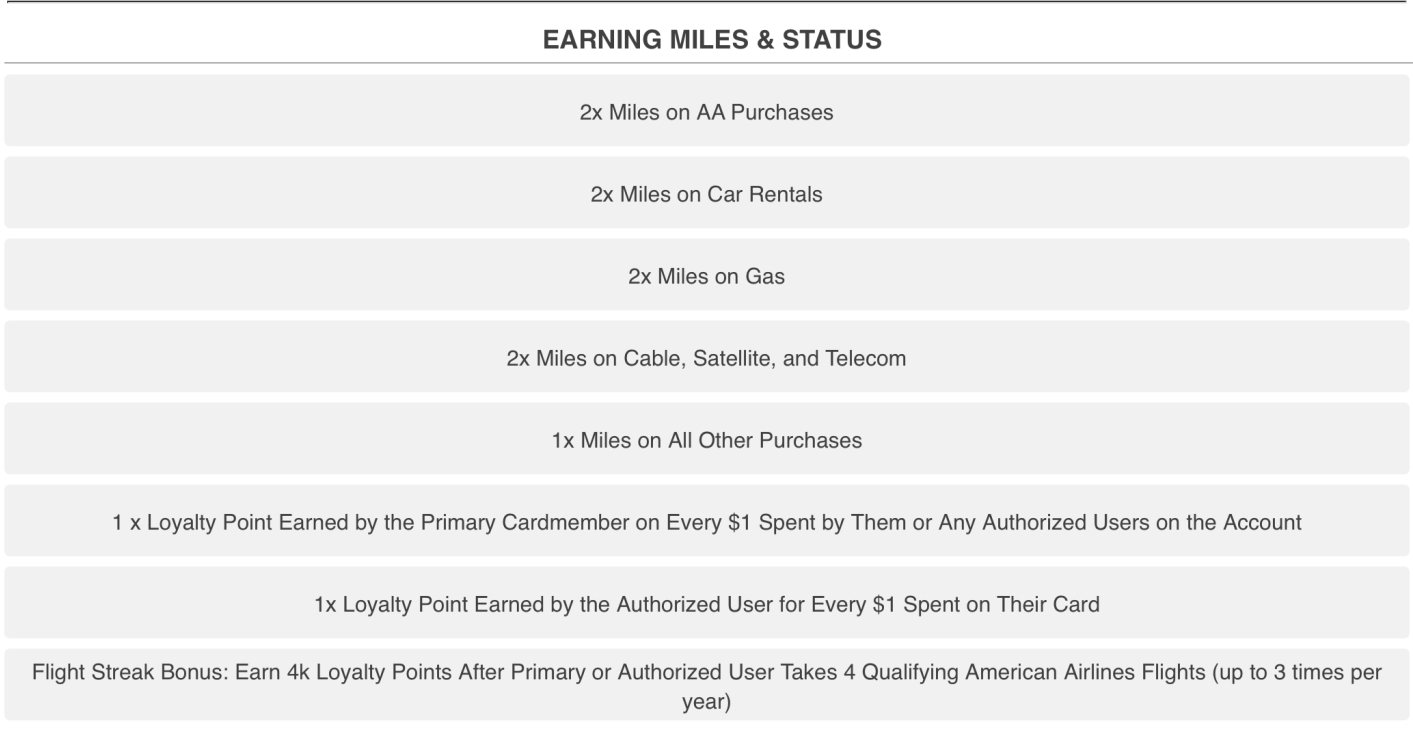

Earn in this example is 2x miles on American Airlines purchases, car rentals, gas, and cable/satellite/telecom and 1x on everything else. But the real benefit is that it earns one Loyalty Point towards status both for the primary cardmember and for the authorized user when the authorized user spends money.

And it would add a ‘Flight Streak bonus’ similar to what the new mid-tier consumer Globe Card provides: 4,000 Loyalty Points after 4 qualifying American Airlines flights, up to 3 times per year (so up to 12,000 Loyalty Points per year).

Statement credits:

- $100 in-flight purchases credit (but American doesn’t sell enough food on board for this to be useful in my opinion)

- Complimentary Walmart+ membership (‘$98 value’ and of course comes with Paramount+) along with Global Entry/TSA PreCheck credit every 4 years

- $100 credit via inKind dining app

Other benefits are first checked bag free (domestic), Group 5 boarding, and travel protections (trip cancellation/interruption and trip delay).

Survey participants were asked which of the following features they valued. Personally I think the last three are what drive value to the card, since other products earn rewards for spend faster.

My key takeaways:

- The would make Loyalty Points-earning for both the account owner and the authorized user for the same spend a permanent feature of the card – not temporary and not targeted. So my wife gets the card, I am an authorized user, and my spend earns status for both of us.

- Adding ‘Flight Streak’ like they offer for the new mid-tier consumer Globe Card with 12,000 bonus loyalty points for 12 flight segments is strong new value.

- And there are some decent statement credits potentially, like a $100 InKind dining credit spendable at over 5,000 restaurants.

This all strikes me as more than worth the $51 increase in annual fee, in addition to the $99 annual fee which opens up redemptions in the AAdvantage Business program, where you earn small business points in addition to the miles from your flying and where you earn an extra loyalty point per dollar spent on tickets that you tag as business trips.

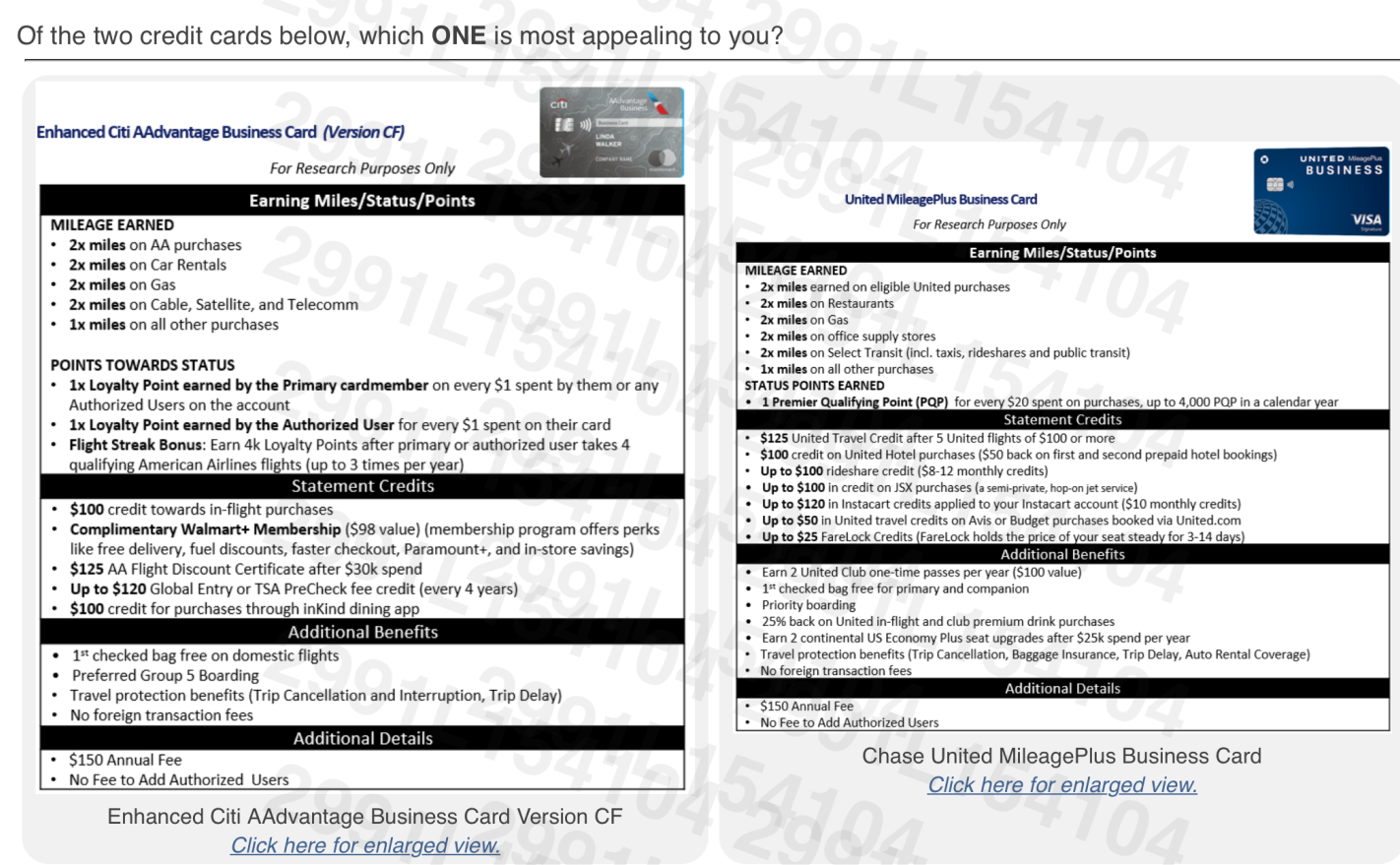

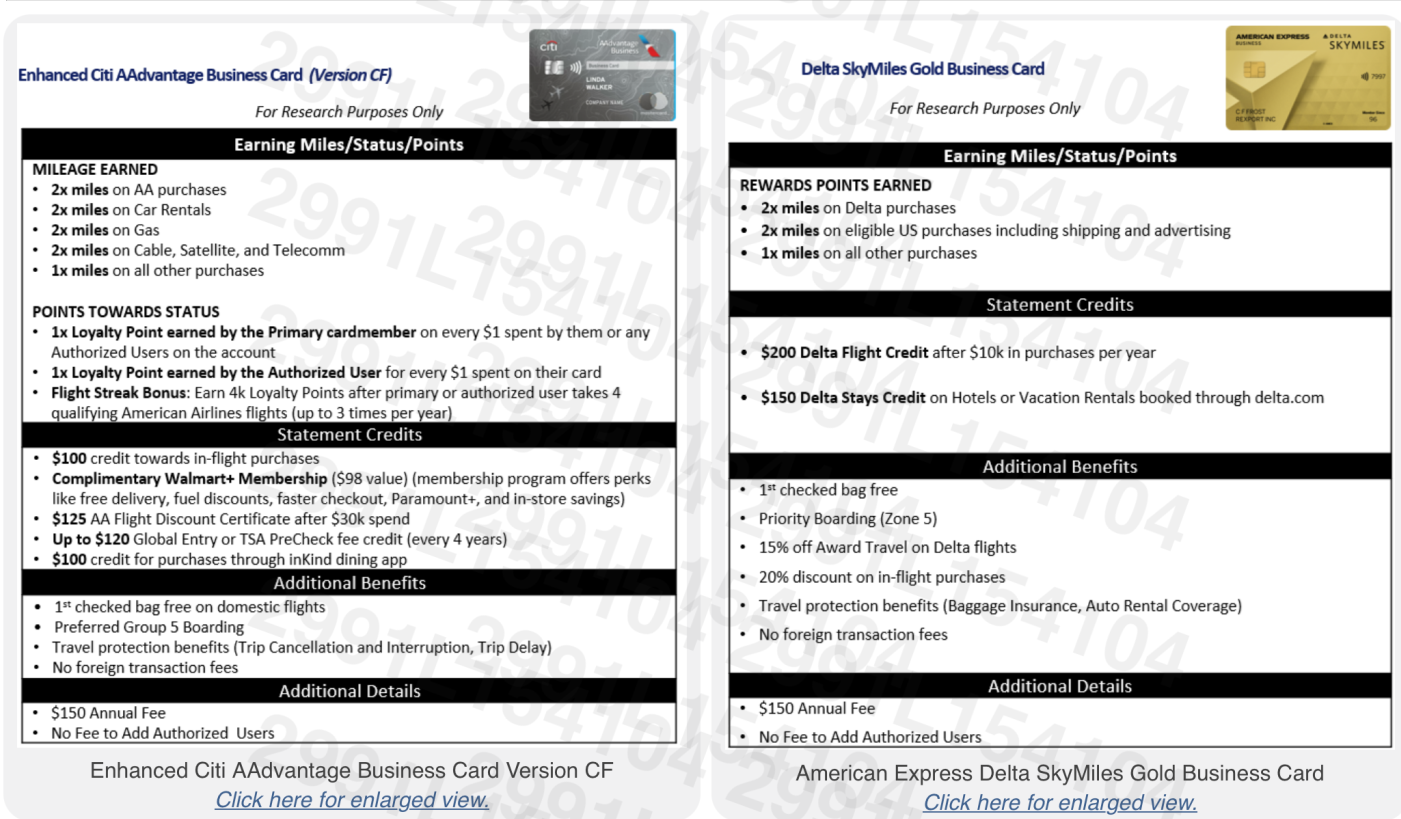

During the survey, customers were asked to compare the proposed card to the United and Delta small business cards, though I’m not sure that’s the right point of comparison. For many people, they’re considering a cash back card (or some other card) and the small business card of their preferred airline – rather than going out and comparing airline cards. A Miami-based small business owner isn’t going to think well, I like the credits on the United business card.

Surveyed customers were also asked to compare the new product against the existing one.

This is one of those rare cases where a product actually looks better for its target market than what’s offered today, even with an increased annual fee.

(HT: Robert)

*yawn*

“$100 InKind dining credit”

*burp*

$51 extra dollars in annual fee

*fart*

Would the flight steak bonus stack with the one that comes with the Globe card?

I got that survey. They compare it to a United card and another AA card with a bunch of coupon crap. Seems like they might considering doing some lounge passes like the United card.

@ymx — Flight… steak? Or streak? If it’s steak, I’m slightly more intrigued!