I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

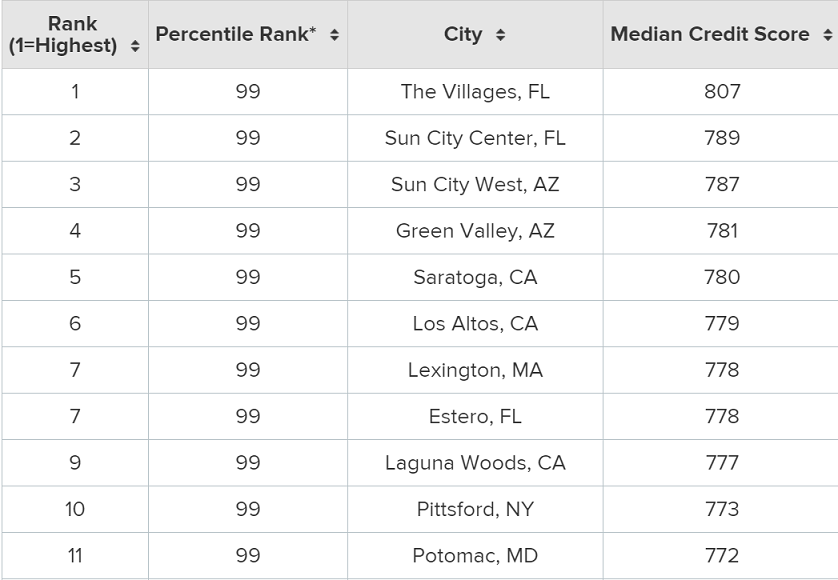

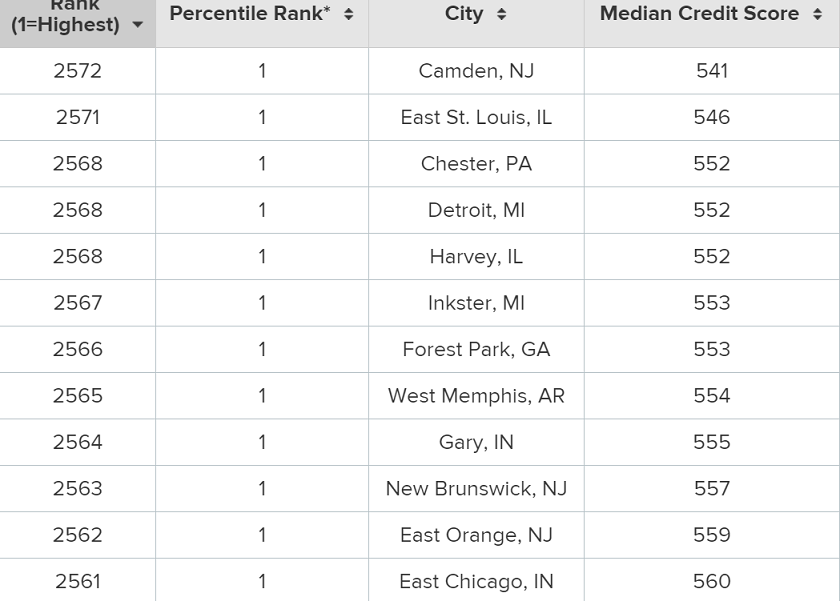

WalletHub broken down the median credit scores by U.S. city and the findings are interesting.

The best scores cluster in areas known for retirement and education as much as prosperity.

While I wouldn’t say the bottom cities are a surprise per se you get pretty far down the list of worst scores before starting to see the Florida panhandle or Mississippi. So in that way perhaps this study at a minimum fails to reinforce my priors, if not refute them somewhat.

It doesn’t take as high a credit score as you think to get approved for many of the better rewards cards (although you probably had best have a credit score that qualifies you to live in Sun City West,

Arizona if you’re applying for Chase Sapphire Reserve). So what do we care about how credit scores cluster by city?

According to research by the Federal Reserve credit scores predict relationship stability. More or less you need to marry someone with a similar credit score if you want your marriage to last. So figure out which city you belong in if you want to find a life long partner. In fact get your credit score up and then get serious about dating because,

Credit scores and match quality appear predictive of subsequent separations even beyond these credit channels, suggesting that credit scores reveal an individual’s relationship skill and level of commitment. We present ancillary evidence supporting the interpretation of this skill as trustworthiness.

All this tells me is that those with the means to pay back their creditors (either through income made from working or investments), are primarily older and live in the areas you would think (old people and retirement income “The Villages”). And those who can’t pay back creditors are younger and/their income is low(er) live in depressed inner cities. I’ve been to Camden NJ, Chester PA, New Brunswick NJ, Detroit, and it’s exactly as the ranking would suggest.

Apparently the largest indicator of bad credit is if your city starts with East

As Captain Obvious noted – this is essentially a ranking of communities by average age and wealth, sorted oldest to youngest.

Saratoga and Los Altos are not retirement communities, they are extremely wealthy silicon valley communities, where teardowns go for a minimum of $2.5 million.

Alternate headline:

“Are Credit Scores Racist?”

@Kacee yes, I’m well aware they are also highly educated

I’d like to see a breakdown by who the clusters voted for in the last election.