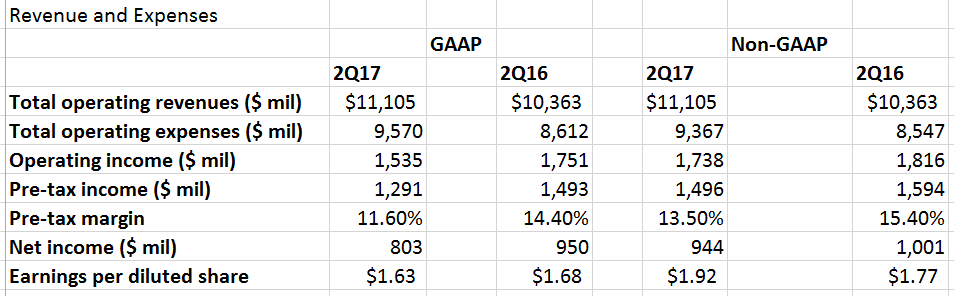

American slightly exceeded Wall Street expectations with its second quarter results earning pre-tax profit of $1.3 billion.

They’re touting the increase in non-GAAP accounting earnings per share year-over-year but of course that’s largely driven by having fewer shares (they’ve been using profits to buy back shares). Profits are actually down compared to the second quarter of last year.

Revenue is up, especially in Philadelphia in Miami (Latin America passenger revenue per available seat mile up 15% year-over-year). Fuel costs are up and continuing to go up. Employee raises are driving up costs as well. And new aircraft continue to be expensive.

American is Paying Employees More But Doesn’t Have Metrics to Know If That Benefits the Company

A couple of financial analysts asked questions about pay increases that American unilaterally offered to employees prior to last quarters earnings call. CEO Doug Parker argued that increased pay and increased revenue are “correlated.” So analysts want to know whether the investment is yielding results.

Parker’s response is that they committed to pay employees comparably with other airlines, and they’re keeping their commitments outside of the bargaining process. They didn’t get anything contractually in exchange for raises. They believe their other investments aren’t as helpful if employees are unhappy, so giving them raises makes them excited and they’ll do better.

But there’s no mechanism to weed out employees who shirk, and no mechanism to reward those who perform well. And crucially, it appeared, no metrics to determine whether it appears Parker’s theory of value creation is being borne out.

Cockpit of an American Boeing 787

American is Among the Most Profitable Airlines in the World But Doesn’t Pay Income Tax

American was able to disgorge itself of many liabilities through the bankruptcy process, but it got to keep past losses to write off against current profits anyway.

As a result it opened the year with $10.5 billion in net operating losses to write off against current federal taxable income, and $3.7 billion in net operating losses to write off against state taxable income.

That’s a huge current and ongoing subsidy to their business from the U.S. government. Ironically the airline’s quarterly report complains about heavy taxation of the airline industry (“For example, as permitted by federal legislation, most major U.S. airports impose a passenger facility charge per passenger on us” yet they don’t mention the benefits of those funds in terms of airport facilities they use).

American Charging Ahead With Basic Economy in Order to Help United Make More Money

United Airlines says they’re losing business to American because American has not rolled out Basic Economy fares across their system. As a result American offers more value to customers. United says they will make more money, taking business back from American, as Basic Economy fares continued to spread at American.

United has said that American’s continued adoption of Basic Economy is good for their business, but American continues to play the greater fool being goaded into what’s good for their competitors instead of themselves even though they do acknowledge in the call “some share shift” they benefit from today. They expect to roll out Basic Economy across the rest of its domestic network by the end of September.

American has convinced themselves it’s better to offer less value to consumers at the same price, because when they do so 50% of consumers faced with the choice spend more. However that’s 50% of the customers actually buying American tickets who are spending more with the airline, and they don’t give us indication of how many customers are choosing not to buy tickets on American when presented with Basic Economy restrictions.

That’s the phenomenon United’s President identified which is costing them money as they charge ahead with their own Basic Economy offerings. Southwest, JetBlue, and Alaska continue to allow their customers to bring on a full sized carry on bag on the cheapest fares. JetBlue and Alaska continue to offer advance seat assignments on their lowest fares. Southwest even allows free changes and free checked bags. And all 3 will offer more legroom in coach on an ongoing basis as well.

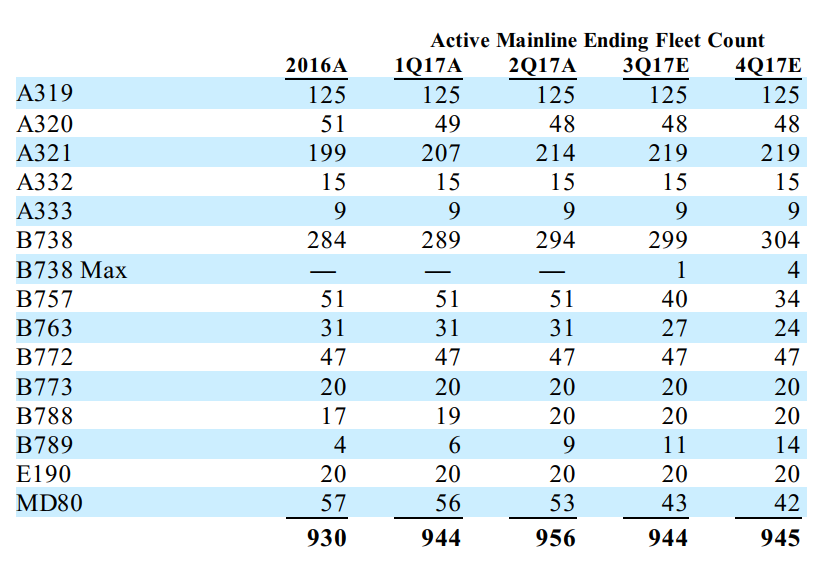

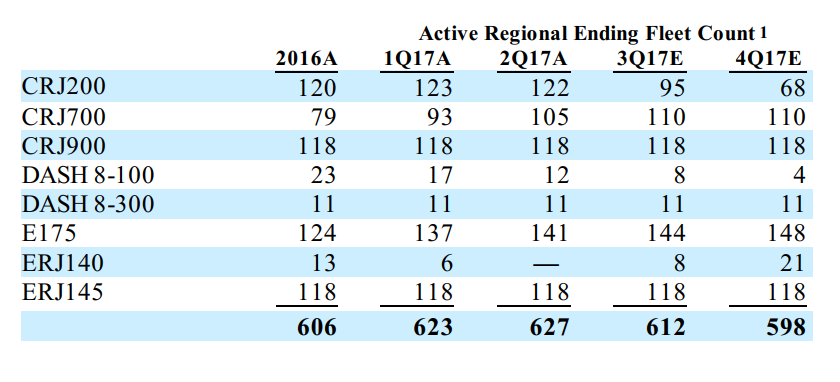

American’s Fleet Plan

American should bring on 57 new mainline aircraft and 63 regional aircraft this year. They’re retiring 42 mainline aircraft and 71 regionals.

Here’s the breakdown:

Why American’s New Less Comfortable Coach Seating Won’t Offer 29 Inches of Pitch

Conor Shine of the Dallas Morning News asked about the process by which they rolled back a plan to put 29 inches of pitch in three rows of the new Boeing 737 MAX, down from a 31 inch standard today. Instead American is going to offer 30 inches of pitch throughout regular economy, made possible through one fewer row of Main Cabin Extra.

Doug Parker began by complaining about leaks. He then highlighted that these are comfortable (sic) slim line seats that feel more spacious.

30 inches is still less room from seat back to seat back than offered today and in my experience and the experience of nearly all customers I’ve spoken with slim line seats are less comfortable not more comfortable as a result of having less padding. They’re bearable for short flights but the new Boeing 737MAX aircraft that will have these seats and less pitch are designed precisely for longer flights.

Seatback TVs are Going Away, Just Like Legroom

When the news came out about their plan for 29 inches of pitch Parker said they got pushback from customers and team members. Flight attendants worried about having to explain the poor product to customers.

Notably American is still densifying its cabin to the same number of seats, they’re just reducing the number of extra legroom seats that customers have an opportunity to escape regular economy into. So this shouldn’t be read as a willingness to do anything other than squeeze in more passengers.

Geez who wouldn’t want to fly transcon on an articulated backboard with 30 inches of knee cram, when for the same price you can get 34″ on Jetblue, choose your seat and get full sized carry-on.

Typical Republican overlord pays no income taxes then complains how high they are. Step fast GOP to give him the billions that pay for poor children’s health care, distract your redneck dupes with trannys in the military,

@Greg – AMEN!!!

Didn’t pay income tax but complained that ME3 was government subsidied thus unfair to competition. What a shameless hypocrite bastard…..

LOL, Ok, now net operating loss carry forwards are subsidies too? You do know that is just a credibility destroying assertion, right?

@Rob – to be clear NOLs aren’t subsidies, NOLs retained through bankruptcy are subsidies. Big difference.

@ Gary. No…NOL’s retained through bankruptcy are not subsidies. The debt that is relieved in bankruptcy is deemed to be income and that income reduces the NOL carryforward dollar for dollar.

You really think the IRS would miss a gigantic loophole like that?

Hopefully people can confine ther comments to the topic and leave politics and name calling aside. I apologize for being a deplorable redneck. Maybe I should give up my Mensa membership.

Who says airline execs have suddenly raised their IQs? Even they can make tons of money with the help of the government-approved oligopoly.

@Rob – the federal government provides huge subsidies to business, it’s 100% legal, that doesn’t make it not a subsidy.

And there’s very careful lawyering to keep it legal, not run afoul of section 382 limits, but it doesn’t mean they aren’t getting a fresh start and there hasn’t been a new company formed and new folks in charge (legacy US Airways) while hanging onto losses that now get used so that they can make big money and owe no tax.

If you apply the standards that US AIRLINES ARE ASKING US TO USE in evaluating Gulf carriers then this is definitely a subsidy.

@Gary, I’m not disagreeing that the government provides subsidies in various forms to business. But NOL carryovers are not subsidies, regardless of whether the company went bankrupt or not. There are long established rules for how carryforwards are determined and entire law firms dedicated to the practice of how to calculate them. The NOL carryforward is often the largest single asset remaining in a bankrupt company and gigantic attention is paid to it. They didn’t just let it slide LOL.

Has Mr. Parker ever planted his carcass in a slimline seat to experience the pain?

I’m with Rob. NOLs to AA are not subsidies, especially considering they didn’t offload their pensions to the public taxpayer. US essentially bought the NOLs and now they are limited in how much they can take annually under the law. Nothing wrong with that.

I love how Gary keeps bringing up 382 like he’s an expert when the Big 4 accounting firms have to have 382 subject matter experts on staff for how complex it is.

Agreed, although I don’t agree that offloading pension obligations is a subsidy. I own 100% of a company and promise a pension to my workers. But say I suck at my business and go bankrupt. I lose 100% of my equity and the court TAKES ALL OF MY STUFF and divies it up to my creditors. How exactly am I subsidized? I think when people make the pension offloading as subsidy argument they are forgetting the all-to-important “the court takes all of my stuff” part of the bankruptcy process.

Even though AA comes out the other end of chapter 11 and is still called American Airlines, it is a brand spanking new company with brand spanking new owners. If there are NOL’s or other benefits built into the company from decades ago, Joe Schmoe as the new owner, paid for that by virtue of the capital he surrendered to purchase the new stock. Nobody subsidized squat for Joe Schmoe, you can’t tell him he got subsidized because in the aftermath of WWII some part of the company’s assets was acquired cheaply because he just paid FAIR MARKET VALUE for the assets of the company.

These quality of commenters here is pretty awesome. Forgive the potentially stupid question, but does offloading pensions to the PBGC qualify as income to offset NOLs even though premiums are paid?

Who is the fool?

While American did concede there was “some share shift” from United, they claimed it was “marginal.” They hardly thought that share was worth keeping at the expense of other revenue initiatives.

On that note, American also said that initial results from all the markets where it introduced its own basic economy fares are good. (Customers are choosing to pay the $20 or $40 dollars more.)

In general, they got credit for increasing total revenue, RASM, and yield.

@ADP I think to the extent the liability is the company’s liability and gets forgiven in bankruptcy it is considered income for purposes of the NOL carryforward, yes. But, my understanding is that the PBGC is essentially an insurance company that companies are required to pay premiums to in order to insure their pension liabilities. So I’m not sure if liabilities that are taken off the books of a bankrupt company and transferred to PBGC are considered a type of insurance proceed, which might not be considered income. It’s too complicated a subject for us who don’t live and breath UCC law.

@gary what about mentioning AAdvantage program and isn’t it true the AA has to incorporate those earning into their bottom line in 2017 which they never had done before?

Can you update the community about this and it’s effects on AA stock prices ( which is having a great run)

@Dana – I write about the accounting changes a bit here:

http://viewfromthewing.com/2017/03/24/can-american-aadvantage-double-airlines-stock-price/

http://viewfromthewing.com/2017/04/01/financial-analyst-claims-airlines-make-money-selling-miles-seats/

While basic economy is terrible for travellers who want want to get more than they’ve paid for, it remains a FANTASTIC idea for legacy airlines who want to destroy the businesses of their low fare competitors. We’re already seeing the carnage: look at what happened to Spirit’s stock price yesterday. I am certain that United and American are more than willing to endure more customer dissatisfaction will these pricing strategies to vanquish the Spirits and Frontiers from their hubs.

@Rob (July 28, 2017 at 6:35 pm) – thanks for your response!

Of course, the airline corporate-terrorist-WHORE IAHPHX doesn’t mention his conficts of interest, yet again. I’m not sure what “more customer dissatisfaction will these pricing” nonsense means, yet I have no doubt about his ignorance…and lack of ethics. Here is what Frontier’s massive growth in looks like:

[sorry, not ‘massive’, rather ‘mega’]:

http://travelupdate.boardingarea.com/frontier-airlines-mega-expansion/

Frontier Airlines DOUBLING IN SIZE:

http://travelupdate.boardingarea.com/frontier-airlines-mega-expansion/

Gary: thank you!

* http://money.cnn.com/2017/07/18/news/companies/frontier-airlines-doubling-in-size/index.html