I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

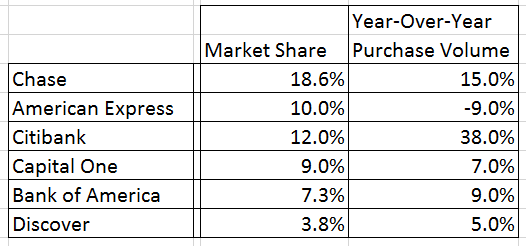

The top 6 credit card issuers handle 61% of credit card purchase volume. Chase is the market leader by a wide margin. American Express and Citibank traded places after Citibank took the Costco co-brand card from Amex, which had been American Express’ largest cobrand deal and substantially larger than Delta at number two (Starwood is number three).

Copyright jetcityimage / 123RF Stock Photo

Since the second quarter of 2016 still had Costco with Amex, American Express’ volume is down year over year although it’s up in the second quarter of 2017 over the first quarter.

Overall card purchase volume grew 10% year-over-year and 11% at the top 6 issuers.

These numbers describe how the market is carved up between banks. And note that the top 4 handle 50% of charge volume. It doesn’t say anything about profitability.

Citbank substantially overpaid for Costco in a deal that American Express wasn’t willing to match believing they’d lose money on it. And American Express had exclusivity over Costco charges, while Citibank only has exclusivity over Costco cards and any Visa can now be used at Costco. Some of Chase’s growth includes Costco charges which they didn’t have in the prior year for instance.

Meanwhile incremental charge volume may cost Chase on the rewards side but doesn’t increase their expenses with Visa which allows growth to pad their bottom line.

So basically tax payers paid for the Costco deal. Stupid effing republicans. Figure that one out yourself.

@Credit ????? would be great for you to show on what basis you are making that claim.

Is “market share” card nos. or charge volume?

charge volume

Amex will continue to drop – it’s an unethical company and merchants generally don’t like the higher transaction costs. Notable how Wells does not even crack top 6. It doesn’t seem to be a priority for them.

@ Credit what do you mean? Not sure what republicans have to do w/ merchant fees or taxpayers at large?

At some level indirectly consumers pay for all of this as stores and retailers build in the cost of merchant fees into what they charge for their goods and services. There’s a reason that auto dealers don’t let you pay more than say $5k on your card when purchasing a card, they simply can’t absorb the 0.50 – 2.0% that they’d have to pay, many merchants will actually give you a cash discount too. Just not sure what you’re trying to accomplish there except to say republicans = bad with no basis or real argument to substantiate that.

If Citi made a deal that did not make financial sense to Amex it was because they used tax credits or something that were available to Amex. Any tax giveaways to the corporations have to be handiwork of the Republicans. So basically money was taken from taxpayers and given to Costco.

Is it simplifying too much? Probably! But the devil is evil is too simple as well without being untrue.

credit, you sound pretty dumb and ghetto. typical obama voter.

@Credit: As wee say in the legal biz — “Assumes facts not in evidence”.

My own wallet supports the conclusion that Chase is the market leader. Of the six cards I carry on a daily basis, five are CHASE, one AMEX. Haven’t dived into the world of citi – yet.