Currently, two banks issue American Airlines credit cards in the U.S.: Citibank and Barclays. The airline’s new cobrand deal grants exclusivity for this business to Citibank starting next year. And Barclays cards are going to move over to Citi.

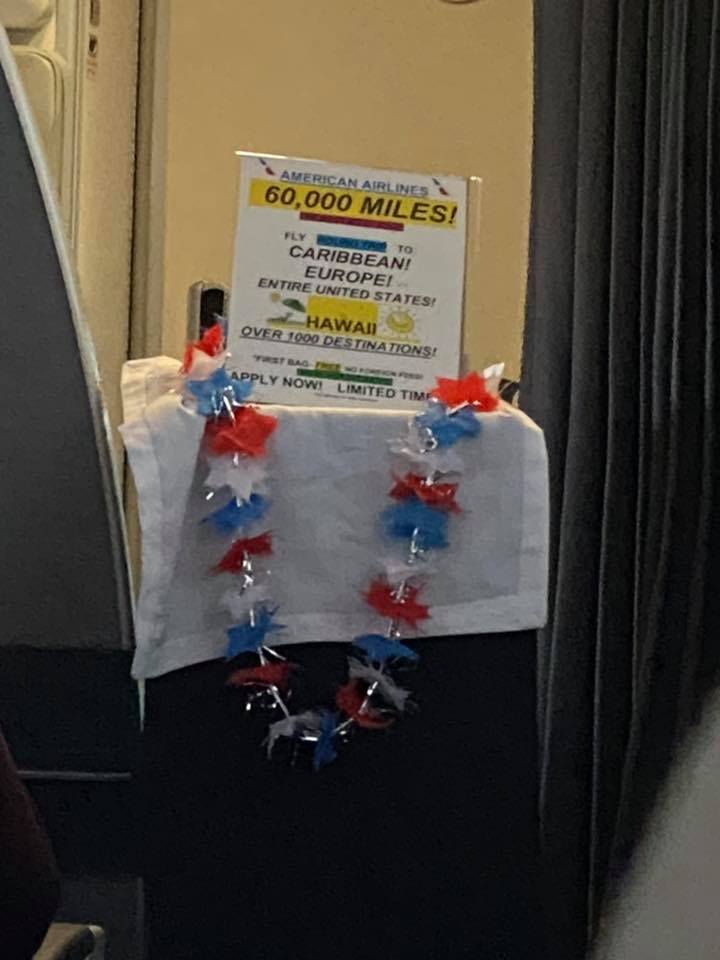

That’s a shame because two issuers means twice the cards. As flight attendants on American flights often emphasize, even if you already have an American Airlines card from Citibank you can get one from Barclays, too.

- Barclays has had exclusivity over inflight marketing and in-airport marketing (except within 100 feet of an American Airlines lounge, which is Citi territory).

- So flight attendants earn commission pitching the Barclays card – and this is good advice. You could get both the Citi and Barclays cards, which means more bonuses and some unique benefits.

Since Barclays AAdvantage cards will no longer be available to new customers once Citi takes over the portfolio, good offers are worth jumping on. And there’s currently a 70,000 mile initial bonus offer after first purchase (no minimum spend) for this $99 annual fee card. The card offers first checked bag free on domestic itineraries and group 5 boarding.

We don’t know what will ultimately happen to unique products like the Barclays AAdvantage Aviator Silver (which was only ever avialable as an upgrade product, not one you could apply for directly). It offers 5,000 status-qualifying points after each of $25,000, $40,000 and $50,000 spend and also lets you earn a $99+tax companion ticket for up to two companions.

But the window to get the Barclays Aviator Red card is closing – unclear whether the rumored September 30 end date is accurate, or if it’ll extend a few months past that, but this is close to your last shot to get this card (so you might as well!).

(HT: Doctor of Credit)

What will happen to current card holders of AA barclays cards ?. Will the card keep working as is or will thr American brand be removed from our cards and the benefits etc, ?

On eligibility, since many of us ‘churn’ and have had it before, I believe it’s cannot have had the card within the past 24 months, and Barclays is generally 6/24, but all that could have changed, and if you get approved it usually works out. At least they usually only hard-pull Transunion; unlike Capital One that does all three. One more time isn’t a bad idea if eligible.

Question for Gary. Do you have any idea what SUB Citi will be offering current Barclay’s cardholders?

I currently have the Silver card and am thinking of getting the Citi Executive AA card when the transfer happens.

Should I get the AA executive card with the current SUB or should i wait to see if there is a better offer in 2026 when the transition happens?

Thanks in advance

@1990

Thanks! I was wondering g.

@1990 I had the same question and the phone agent didn’t have a precise time frame but told me, in sum and substance, that if I didn’t qualify for the bonus Barclay’s wouldn’t approve me for the card. I was approved, and they seem ready to pay me my 50K miles (no annual fee).

@Mak — Well done! Enjoy those 50K!

@Daniel – My understand is Citi will buy the Barclays portfolio, so cards keep working. Unclear which benefits will change or when. But they’ll still be AA cards.

@Steve – no idea what future initial bonus offers will be, but i wouldn’t expect anything targeted at barclays cardholders per se, since the barclays cards should just transition over to citi

If this card will be transitioned to a Citi within the next few months, does that mean we can’t get a SUB for the Citi version of the card in the near-term? Or would one still be eligible since they signed up for the Barclays version?

@Rob — No one knows yet, but there could be a risk (of becoming ineligible for future SUBs for a period), or not. Hopefully, Citi would consider it a separate ‘product’ for those purposes. If you’re currently eligible for this Barclays card, I’d give it a go, because it’s such a quick, easy way to earn a lot of points, which kinda outweighs whatever future bonuses on the Citi-side. Good luck out there!

Gary, many thanks for posting this link, which is 20k miles above the one on Barclays’ website. The landing page is a bit sparse though — are you sure there’s no minimum spend, apart from one transaction and payment of the $99 annual fee?

@Ned — +$1. It’s one of the best.

Link doesn’t work anymore.

I applied yesterday from the link you provided for 70,000 miles. I had previously held this card but it has been over 2 years, so I reapplied. I did not get an instant approval, but was contacted this morning, less than 24 hours from original application and was approved (after some verification questions). I already have the card (last four digits) in my Barclays account showing I just need to make one purchase and pay the $99 fee to earn 70,000 miles! However, this morning my husband tried the link to apply and got this response:

We apologize for the inconvenience, but our website is experiencing technical issues.

Please contact us at 1-800-308-6008 or try again later.

link doesn’t work anymore