I receive compensation for content and many links on this blog. Be aware that websites may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. Citibank is an advertising partner of this site, as is American Express, Chase, and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

We know that American Airlines is below expected credit card signups this year.

Their 8-K filing with the SEC didn’t tell us whether that was on the Citibank side or the Barclaycard side, since American has two credit card issuers. But since Barclaycard only started adding cardmembers in mid-December it was a good guess that Citi applications were a driver.

They responded by offering the biggest publicly available signup bonus I’ve seen for their standard cards.

The Barclaycard AAdvantage® Aviator™ Red World Elite Mastercard® increased its signup bonus as well from 40,000 miles to 50,000 miles. That requires only paying the annual fee and making a purchase, not minimum spend.

What was curious though is that I hadn’t seen an increased offer for the Citi® / AAdvantage® Executive World Elite™ Mastercard®, American’s premium card that comes with club lounge membership.

That’s a $450 annual fee card, comes with American Admirals Club membership (and access to American Airlines clubs for up to 10 no additional fee authorized cardmembers as well) and where $40,000 spend on purchases that post to your account during a calendar year earns 10,000 elite qualifying miles.

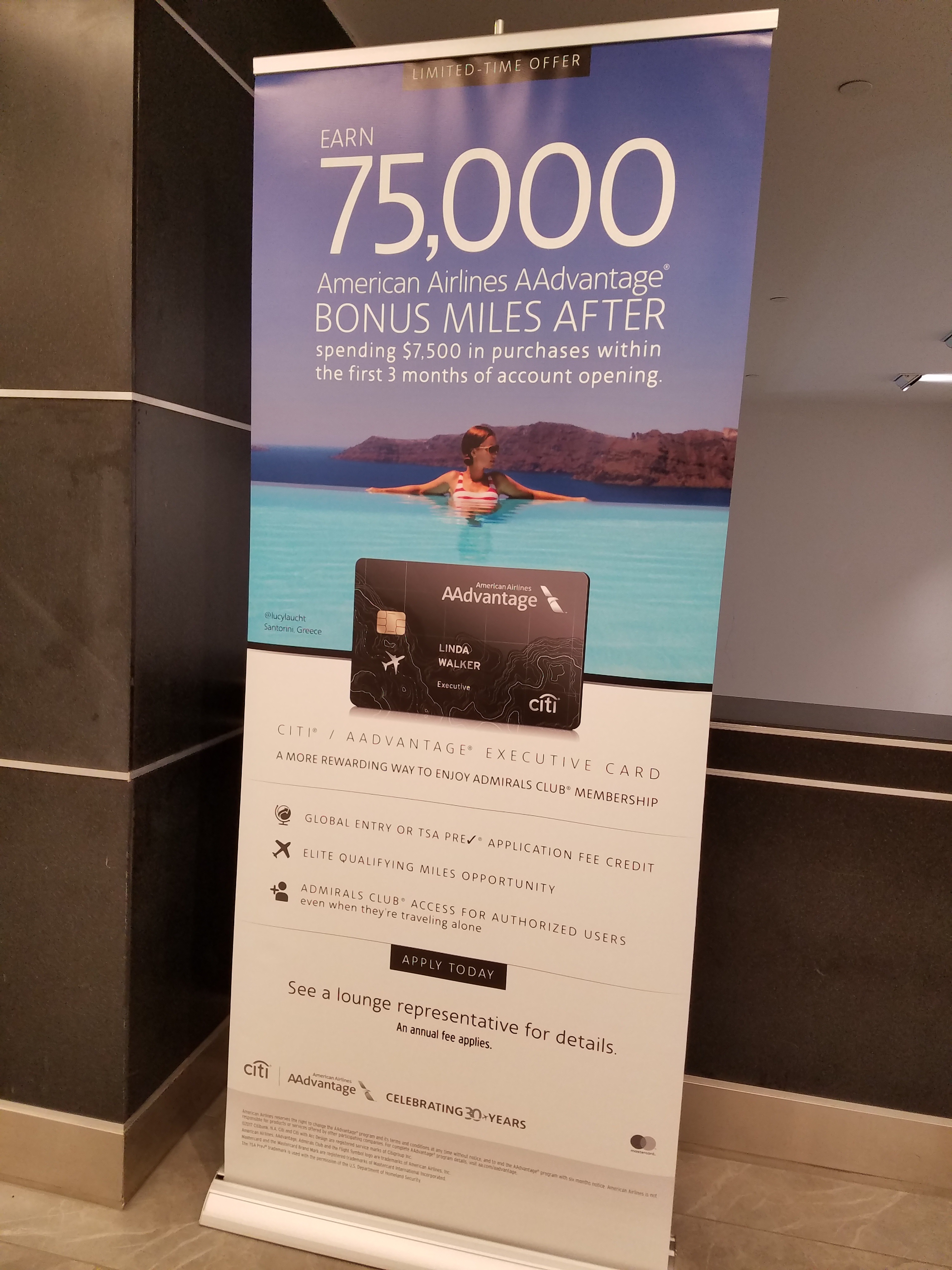

However I was in the New York JFK Admirals Club last night and saw an offer being promoted for 75,000 miles after spending $7,500 in purchases within the first 3 months of account opening.

I don’t think these are super cards for your ongoing spending, but they’re all great for the signup bonus, and they can make sense to keep if you fly American Airlines a reasonable amount.

Does the 24 month rule apply?

Thanks for the sharing the info Gary, despite the fact that it arguably hurts your opportunity to be rewarded … maybe this will shut up the haters.

The problem is the diminishing value of AA miles due to the award availability at the sAAver level. I still have Barclay card because of 10% rebate on AA redemption but I have spent almost nothing on this card over the last year. Instead of double AA miles I am charging my AA travel to Chase Sapphire. Basically, I am paying $95 for 10,000 AA miles because I always redeem >100K per year. Just last week I have received an e-mail from AA to remind me of EQDs that come with the spending. I have no use for that either because I already re-qualified for EXP with $13.5K in spending. Unless AA returns MileSAAver awards, I have no intention of giving AA my credit card spending. Even the 75K signing bonus is a bad idea because $7.5 in spending could be used on another card.

My wife keeps on getting a 65k offer for the Platinum Select card snail mailed to her. Given the difficulty of using AA miles, we are not biting.

Good offer Gary, what was the offer code?

offer is at http://www.citi.com/lounge

75K offer also in DCA club today.

@Leighton – link to the application is in the post (twice)

Does anyone know if the CitiGold discount of $100 on the annual fee apply to this offer.

I was in the A Club in CLT on Sunday and the offer was 50,000 so it must have changed Monday.

I have considered the AA card, but everywhere i read eveyone says redeeming the AA mikes is near impossible, so why have them

AA Saver Awards — aren’t those an endangered species? Or, are they extinct now?

It’s a waste of time to earn AA miles. I canceled my AA credit cards.

Its kinda weird to see a pic of the Austin A Club entrance in your post when you ate talking about one of the JFK Clubs. Are the pics of the offers posted sideways on purpose for some reason?

On topic, the gold standard is the past offer by AA for their MasterCard with first year fee free and 100,000 miles sign up bonus. It also came with a nifty combo pen / penlight. Anything less and I’m not interested