I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

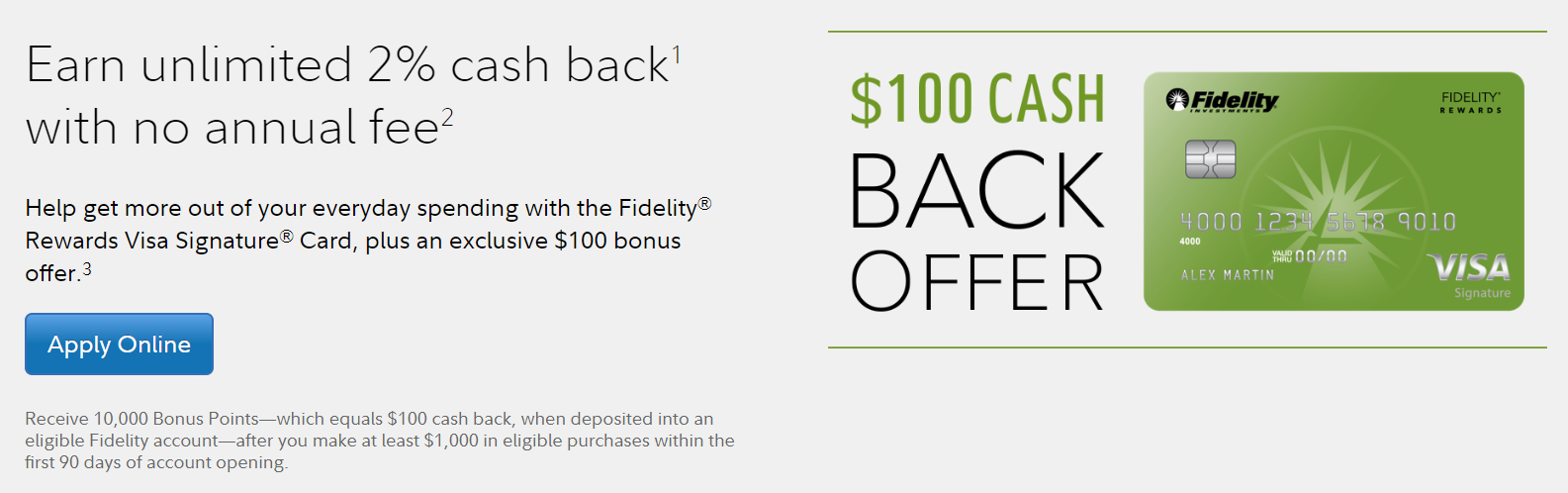

The Fidelity Investment Rewards Visa has a signup bonus of $100 cash back after $1000 in eligible purchases within the first 90 days of account open. (HT: Doctor of Credit)

They’ve offered this before but not regularly. More often than not this card has had no signup bonus at all.

Fidelity’s 2% back Visa is one of the two best cash back cards. The Fidelity card has no foreign transaction fees, but requires a Fidelity account.

If you’re going for cash back — and some people should, especially those who earn most of their points from ongoing credit card spend and use those points for domestic coach travel — then 2% is the gold standard. You can even earn 2% cash back and then use the cash to buy miles when airlines are selling their miles for less than 2 cents apiece. That’s better than earning 1 mile per dollar on an airline credit card.

That’s interesting, but I wonder if one is better off using the Chase Freedom Unlimited that gives 1.5 UR points for everyday purchases. Isn’t that more valuable than 2c per dollar spent? And that gets even more valuable for travel when one transfers points to the Chase Sapphire. Am I wrong here?

Perhaps this card is good for folks who don’t travel….is it?

After a Gary Leff tip a few years ago, I got an Alliant Credit Union Visa that paid 3% cash back the first year and 2.5% cash back after the first year. For unbonused spend, I think it might be the best cashback deal out there.

I list seven 2% cards. My favorite is the State Department Federal Credit Union Visa credit card

2% cash back on all purchases.

$200 bonus cash rewards when you spend $3,000 within the first 90 days.

No annual fee.

No fee for foreign transactions. (The only 2% cash back card I know of that does not have this fee.)

Doctor of Credit tells us how everyone can get this card for free by first joining the American Consumer Council and entering consumer in the Promo Code box.

The Fidelity card has a 1% foreign transaction fee, netting you 1% on foreign transactions.

Paypal Mastercard also gives 2% back with no foreign transaction fee, but you need a Paypal account.