United’s CEO Scott Kirby went out of his way on the earnings call to “draw a line in the sand” in Chicago—promising United will add flights to match any American expansion at O’Hare. The point of saying it publicly wasn’t bravado. It was deterrence: to signal to American (and to analysts) that new Chicago capacity will be met in kind, making growth less attractive for both airlines.

United Airlines Concourse, Chicago O’Hare

American’s response came fast anyway, announcing new routes from O’Hare—turning Kirby’s game-theory warning into an immediate test of whether this becomes a real fare war or a negotiation by headline.

The line that got the most attention out of Wednesday’s United Airlines earnings call was that CEO Scott Kirby is “drawing a line in the sand” in Chicago. Whenever American adds flights, United will add flights too.

But everyone missed United’s strategy here. No one questioned ‘why is United talking about this publicly?’ The reason is they were signaling to American, and putting pressure on American via Wall Street, hoping that neither one would grow capacity in Chicago.

Chicago O’Hare Airport

Here’s what Kirby said.

I was afraid we were going to get through the call without addressing Chicago. So I’m happy to do it…

In 2025, American added gates. That means we watched it. We could have responded. We chose not to. They’re going to win 3 gates back at our expense when the analysis comes out later this year. We knew that was going to happen. We figured we’d just let it settle into a new normal and that would all be fine.

But in 2026, we’re drawing a line in the sand. We are not going to allow them to win a single gate at our expense in 2026. We’re not trying to win gates, but we’re going to add as many flights as are required to make sure that we keep our gate count the same in Chicago.

…American, and we’re pretty good at estimating this is likely to push to about $1 billion in losses in Chicago. But we’re going to just stay focused on the strategy that’s worked for the last decade.

Tunnel Between United Concourses at O’Hare

United has grown in Chicago, and up until recently American largely ignored the city coming out of the pandemic. American retired too many planes, and didn’t ramp up capacity because they wouldn’t have been able to grow as much in places like Dallas and Charlotte. The city re-allocated gates based on flight volumes early, this was probably illegal, and American had to go buy gates from Spirit Airlines to support its plans.

As American grows, that could mean getting some gates back that were taken away and (effectively) given to United. United doesn’t want to see that happen.

American Airlines Boeing 787-8 in Chicago

The United comments were covered straight in the press, without asking what motivated the public ‘line in the sand’ announcement. Here’s also coverage from The Points Guy and from One Mile at a Time.

Yet Kirby was very explicit that he wanted to talk about Chicago. He’s not just planning a competitive response in Chicago even if it means driving down fares and making less money than they otherwise would. He wants to publicly talk about what he’s going to do with capacity, in response to moves by a competitive, for classic anticompetitive reasons. He wants to make it harder for American to add capacity.

- If American knows that United will add flights in response to American adding flights, so that American doesn’t gain back any gates, they might be less likely to add the flights in the first place. Kirby is telling American that they can both be better off financially by constraining capacity. They wind up in the same place, without both losing money fighting in Chicago.

- Once Kirby tells analysts that he’s going to respond in-kind to American’s moves in Chicago, there’s going to be skepticism from analysts that American should grow in Chicago. There will be outside pressure on American not to grow in Chicago.

- United’s threat may be true, but it doesn’t even have to be in order to exert pressure on American via Wall Street!

United’s CEO isn’t just sharing his playbook publicly for sport. It’s game theory. By announcing that United will grow capacity in response to American adding flights, he makes it less likely that United will have to grow capacity in Chicago, because it’s less likely that American will.

Here’s what United told employees, as well, about American’s growth in Chicago as reported by aviation watchdog JonNYC:

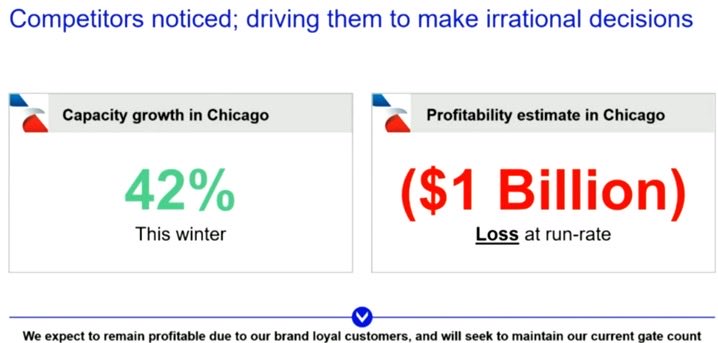

“They pointed that AA’s 42% growth is in the winter, a large amount of growth that will almost certainly be unprofitable, given the time of year it’s being added.”

— JonNYC (@xJonNYC) January 22, 2026

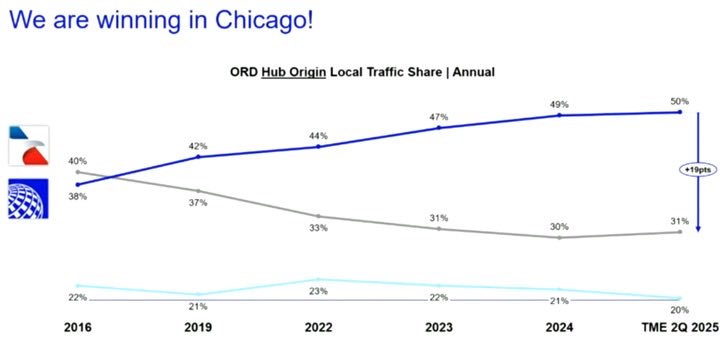

JonNYC also shares the slides from United’s internal presentation showing American winning in Chicago in 2016 (the year American fired Kirby is chosen as the base year, naturally) and how their position has eroded.

American, for its part, responded:

“While it’s clear that one hub carrier would prefer less competition at O’Hare, the inconsistent, third-party claims regarding our performance in Chicago are unsubstantiated,” American said in a statement.

“Two competing hub carriers means ORD is positioned to provide lower fares and more options to travel to, from and through Chicago. That competition is inherently good for the City of Chicago and economic development in the region, as well as for consumers, both in Chicago and beyond, and is a key contributor to O’Hare’s return to the busiest airfield in the nation in 2025.”

American Airlines Concourse at Chicago O’Hare

American doesn’t deny they’re losing money in Chicago. They are. It may not be the $800 million that Kirby suggests (and they may not lose the $1 billion be projects they will). But simply say that the amounts United claims are “unsubstantiated.” And they’re unsubstantiated because American doesn’t break out its losses by hub.

United’s number for American’s losses in Chicago is high. Kirby’s claim of $800 million was actually hedged and dubiously based on an unrelated questionable number from American about how much business travel it’s gained back in the past year and a half. Kirby said that if American was actually making that much more money on business travel, but their revenue didn’t go up, then they must be losing it elsewhere, i.e. Chicago. They aren’t actually making that much more on managed business travel, and American’s losses in Chicago are largely cost-driven rather than revenue-declines in any case.

In fact, in the second quarter of 2025 the airline’s losses in Chicago were likely ~ $70 million. Big annualized losses, to be sure.

American Airlines Planes In Chicago

American already responded, though, with an announcement of new flights from Chicago O’Hare to Allentown, Pennsyvlania; Columbia, South Carolina; and Maui and also adding flights from Los Angeles to Washington Dulles (an old route they used to fly) as well as Cleveland. The Chicago regional routes are twice daily while the Maui route is daily.

I love to see the aggressive fight coming from American, finally! They’re the underdog here, they don’t have enough widebody aircraft after retiring Airbus A330s and 767s during the pandemic and deferring some deliveries (a 787 will be used to Maui), and they need to order more. And fighting in Chicago leaves them vulnerable elsewhere. They never responded when Delta added Miami – Austin so as soon as Delta gets more gates in Miami you can expect them to come after that American hub, something they’ve been eyeing since stealing the LATAM partnership out from under American.

There will be analyst questions about Chicago during American’s earnings call Q&A on Tuesday. We’ll see what they say about ratcheting up in the face of Kirby’s comments – and how sustainable it is.

In Casablanca, Humphrey Bogart’s Richard Blaine opens the film as an isolationist, noting “I stick my neck out for nobody.” Late in the film, after Rick helps Victor Laszlo escape ultimately to America, Laszlo says “Welcome back to the fight.” Unlike Laszlo, I don’t know which “side will win” and I’m not confident based on recent track record at American that it’ll be them. They’re the underdogs!

Still, it’s great to see them awakened, because what they were doing wasn’t working. Their positions in Chicago, New York, and Los Angeles – and the credit card spend that goes with it – were slowly being eroded. And it’s that spend that’s the linchpin of where they’re still profitable.

Gary, is the estimated $70M loss for second quarter after attributing all revenue or just operational loss for the hub?

Why can’t AA just reactivate the retired planes?

Those planes aren’t around to reactivate. Moreover, most of them were older (other than the 330s) were old and on their way out. Sure, if AA had kept them in airworthy condition the A330s and the LAA 757s could have been brought back. The 763s and the LUS757 were just not worth bringing back.

Other than the handful of A321neos acquired from AS and A319s from Frontier, AA hasn’t been too keen on looking for second hand a/c.

At least we know that Gary’s neutral. There’s a Tortas Fronteras in both Terminal 1 and Terminal 3.

Sadly Tortas is in decline

Gary fwiw I ate at Tortas for the first time over the weekend and thought it was pretty good

Instead of a ‘line in the sand,’ did they consider just ‘pounding sand’?

Tortas at ORD are mid.

Remember this comment.

Kirby’s obsession and hatred towards American will be his ultimate downfall. Period.

@IsaacM – used to be great, no longer is even mid sadly

@Jay – used to be so much better!

Kirby is truly afraid of what AA is starting to become. His “Trump” Jr jr routine is wearing thin with a lot of people in the public and at the airline.

In my career I worked in brand marketing at two major airlines. When I was a new hire at the first airline I was told by a MD that a priority for any airline CEO will always be to “Protect Our Hubs”. I’ve seen that played out more than once.