I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

There are many great ways to earn miles, and many of those are neglected by the average frequent flyer. While the greatest miles and points deals ever are long gone, that’s how these things work. The best deals don’t last. Which is why it pays to stay alert, and not leave miles on the table.

- I’ll never forget earning 20,000 Delta miles for a Bosley hair restoration consultation (I had more hair back then). I used to benefit mightily from United’s GroceryMiles program with Safeway. And then there was dumpster diving at Wendy’s..

Back when I started in miles and points there weren’t even airline alliance awards. You couldn’t combine different airline partners on a single ticket. Most programs required you travel fly roundtrips. Credit card bonuses were much smaller (I had never seen a 20,000 mile signup bonus before 2003). The only card that had spending category bonuses was Delta’s American Express.

Miles and points are a counter-cyclical space. When the economy is bad, airlines print a lot of miles to fill incremental seats. And with plenty of empty seats award availability is easy. When the economy improves, there are fewer unsold seats so airlines don’t need to spend as much on marketing and awards are tougher to get.

And award chart prices rise, they rarely fall, so my advice remains to earn and burn in the same period — accumulate miles based on the value proposition in front of you, and then spend those miles before the value proposition changes.

Credit Card Signup Bonuses Are the Easiest Way to Big Miles

The first card you should get is the Chase Sapphire Preferred Card. It has a great bonus of 50,000 points after $4000 spend within 3 months of account opening. The card has great earning, and points transfer to airlines in all 3 major alliances, airlines outside alliances and hotel programs too.

Sapphire Preferred is the first card you get because Chase seems not to approve cards for people with too many new accounts in a two year period. So getting this lets you get other cards from other issuers, without the tradeoff. And for folks new in the hobby, $450 annual fee cards – no matter how good — are a tough sell, so a $0 annual fee the first year (then $95) has a much lower barrier to getting started.

Singapore Airlines is a Chase Transfer Partner

Signup bonuses remain the quickest and easiest way to earn plenty of miles quickly.

Credit card Spending Bonuses Help You Earn Quickly

If you want to earn the most points for your spending — beyond just earning a big signup bonus — you need to pay attention to what you spend the most money on and which cards give you the best juice for that kind of spending.

If you drive a ton you want a card that maximizes gas spend. If you eat out a lot, there are cards that bonus restaurant spend.

Since I travel a lot it’s air, hotel, and dining. Some cards are great for multiple categories.

If you’re like me it’s hard to go wrong with the Chase Sapphire Reserve which gives you triple points for both travel and dining. If you’re a roadwarrior, it’s a tough card to beat as a first card, and for a hard core points active the Sapphire Reserve is well worth the $450 annual fee.

Earn Big Bonuses on Everyday Spend Like Gas and Groceries

Mileage Shopping Portals Give You Miles for Things You Buy Anyway

Sometimes the mileage amounts are fairly small, if you’re only spending $20 and you’re earning 3 miles per dollar that’s 60 miles.

But you’re earning miles for things you’re going to buy anyway, just start your online shopping at a mileage portal and click to the store of your choice instead of going to that online e-tailer directly. Most online stores give miles or other rebates for your shopping if you do this.

And the rewards can actually wind up quite large, 20 miles per dollar and I’ve even earned 100 miles per dollar on certain purchases without a promotion to stack – and promotions do abound all the time, especially around the holidays, back to school, and other peak shopping seasons.

Remember those miles are in addition to what you earn for putting the purchases on your mileage-earning credit card.

Here’s how to choose which mileage portal to use for your shopping, and here’s my interview with the President of Cartera Commerce which runs many of the sites.

Some people turn this into a business, finding items they can sell for about what they paid for them (or at a profit) and also pocketing the miles or other rebates. There are some big players in this space, it’s not something to enter in without being sure you can get your cash out. But there are folks earning hundreds of thousands of miles a year this way and thousands of dollars too.

Earn Miles By Actually Flying

While 6 out of 10 miles are earned for something other than flying, flying remains a significant source of miles accumulation.

Airlines have been pretending that frequent flyer program changes are about ‘better rewarding’ high spending customers since the mid-1980s. The change to revenue-based earning for flights doesn’t really do that. A $400 ticket between Washington DC and Boston gets rewarded the same as a $400 ticket from DC to Los Angeles — or Singapore.

And of course the major airlines have taken the opportunity to devalue their award charts at the same time they’re changing the way miles are earned. So even if they’re rewarding some flyers with more miles, those miles are worth less. American conceded that its change to revenue-based earning would mean fewer miles earned after the change than immediately preceding the change.

Still, you can earn miles for your flying. And on average it’s not that many fewer miles than before. Break-even earning comes roughly at a ticket price 20 cents per mile flown. Short expensive flights earn more, long cheap flights earn less.

American Airlines Beoing 787-8

Looking at my own travel spend I roughly break even or come out slightly ahead now that American AAdvantage awards miles on the basis of ticket price.

Opening investment accounts

I used to use Sharebuilder for opening account bonuses, and earned big miles from Fidelity.

Miles Every Month for Your Checking Account

I’ve used Bankdirect as my primary checking account since July 2003. They give me 100 miles for each $1000 of average balance each and every month, and there are signup bonuses as well.

In a low interest rate environment this is a pretty good return, especially since there’s no tax reporting on the miles but you’d pay tax on interest earned (such as it is these days, on a checking account).

Copyright: micchaelpuche / 123RF Stock Photo

They now cap mileage-earning based on a $50,000 balance, but that’s still 5000 miles per month if you max out (at a monthly fee for the checking account of $12). And you can earn up to 21,000 bonus American AAdvantage miles for a new account.

Miles for Watching TV

Signing up for DirecTV can be used to earn 25,000 or 30,000 miles at a time — and with a little bit of effort service can be cancelled and re-upped earning miles multiple times especially when you cycle the names of household members your service is under. If you’re going to have TV anyway, you might as well get lots of miles for it.

Miles for Your Airport Spending

I’ve gotten value from Thanks Again earning miles at brick and mortar retailers when I didn’t expect it. You register your credit card and then automatically earn miles at participating merchants, using the same kind of system that Rewards Network uses for dining to make the whole thing seamless, working in the background.

You can go out of your way to earn miles with their merchants, choosing to do business with the ones that rebate miles to you, or you can sign up and be surprised when you happened to earn miles without realizing up front that you would.

They’ve given me signup bonuses, and mileage-earning with them has counted towards larger partner bonus promotions.

I interviewed their CEO last year and he explained their business model, which is mostly rewarding the spending you do at airports automatically as long as you’ve signed up for their program.

Miles for Living at Home

When I bought a condo in 2006 I earned six figures in United miles for being referred to a realtor. Basically they were rebating a bit more than half their commission in the form of United miles.

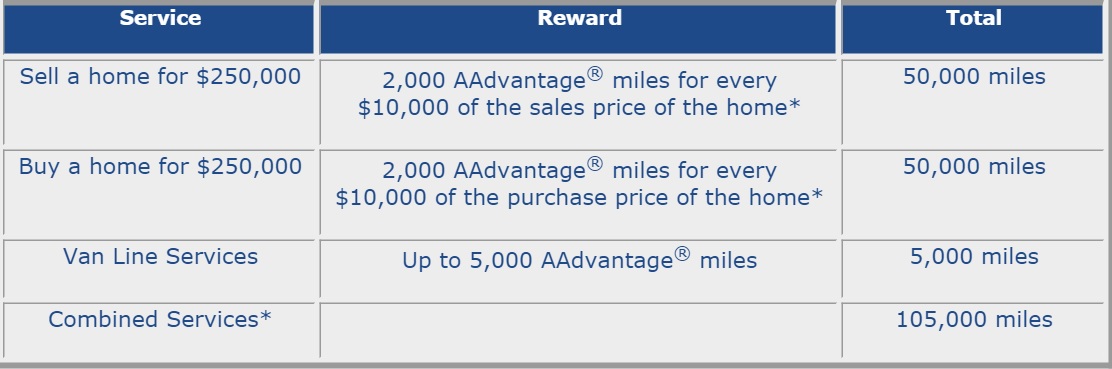

There are opportunities to earn miles for mortgages as well, and for using a moving company. Big dollars are involved in real estate, so big miles are too.

American Home Miles will give you American AAdvantage miles for the real estate transaction, miles for working with them on your mortgage, and miles for using the moving company they refer you to. In each case they’re rebating a portion of commission.

Miles from Home will give you American AAdvantage miles for real estate transactions and mover referrals. They don’t do miles for mortgages.

Miles for Car Rentals and Hotel Stays

Hotel loyalty programs didn’t catch on as quickly as airline programs. So initially hotels ‘rented’ the airline programs by rewarding customers with the airline miles of their choice.

Hilton HHonors sold their proprietary program by telling customers that they didn’t have to choose miles or points — sure, they valued their airline miles, and Hilton would give you those. And you could earn Hilton points, too. That was called the ‘double dip’ and it was Hilton’s unique selling proposition. Sadly the double dip is going away.

Early on that helped Hilton build its customer file. Eventually hotel programs gained traction and earning airline miles became less important. But in part as a holdover from those earlier days you can earn miles instead of hotel points in many programs, or transfer hotel points to miles.

Car rentals are another source of miles. Rental agencies will usually charge to recoup the tax on their purchase of the miles (7.5% of the cost but in theory you can get that back).

I find that Avis has the best mileage promotions, of 500 or 1000 miles a day. You don’t get very far on 50 miles a day but even that earning can be useful. Many times I’ve kept a completed Avis car rental reservation without miles assigned so that I can request the miles later in my choice of program to extend an account’s expiration.

Earn Miles for Eating

Dining for miles is one of the easy and free ways you can rack up points. Register, use your credit card when you dine out, and if it happens to be at a participating restaurant you’ll earn miles automatically.

Rewards Network is the company that provides branded mileage-earning dining programs in conjunction with major frequent flyer programs like United MileagePlus, American AAdvantage, and Delta Skymiles.

When I first started earning with them in the mid-1990s, United’s program was only open to their elite frequent flyers. (I Was actually excited to start earning miles for restaurant spend when I first became a Premier member in 1997.)

I used to rack up miles by choosing to schedule reimbursable business meals at participating restaurants, and steering groups of friends towards those restaurants — where everyone would kick in cash and I’d earn miles for the total bill that I’d put on my credit card.

Sadly the program became a whole lot less valuable July 1, 2005. But it’s still better than a hole in the head, as my grandfather used to say.

The real value comes out not just from earning a few miles per dollar on your restaurant spend (on top of the miles you earn paying by credit card) but from the bonuses that they offer. There are regular signup bonuses and incentives to review restaurants as well.

Pay Bills and Earn Miles

It’s obvious you want to put as many expenses on your mileage-earning credit card as possible. And many companies let you pay bills with a credit card at no cost through their website.

But it sure feels like ‘wasting’ spending when you have to write a check or make an electronic payment and don’t earn miles.

Plastiq is a service that will pay your bills and charge your credit card for a fee. You can pay mortgage and rent (Mastercard only) or any bill from a vendor that will take a check (Visa/Mastercard/American Express). They bill your card, they mail a check.

That’s not always worth it for the usual 2.5% fee but they sometimes run specials to pay bills at a lower fee. It’s a great way to meet big spending requirements on a card, however.

And they have a referral program that lets you earn free bill payments as well.

Miles for Insurance

Miles are an all-purpose currency, companies buy miles as a way to reward customers and incentivize activity.

If an insurance company wants to generate a qualified lead, they can give out miles for getting an insurance quote. It’s a small cost for someone they learn a lot about.

I’ve gotten plenty of insurance quotes over time, although some – especially that ask for a social security number to give a quote – may run your credit in the process.

Surveys

When I joined e-rewards, the miles for taking surveys site, I did it generically through their home page and thus had the ability to redeem points for miles with any of their partners.

Now you can only join through a link that partner frequent flyer programs send you, and then you’re restricted to earning miles in that program. So choose whom you sign up through carefully.

In generally I’ve found the surveys take more time than the miles are worth, but it can be a useful way to earn a few points and keep an account active. And students often have a low opportunity cost of time, you can click your way through underutilized leisure time and earn a portion of a free ticket.

E-miles is another survey site, their surveys are quicker and usually fewer points, eventually you earn enough to redeem for 500 miles. I’ve only ever redeemed when there has been an airline partner bonus — move points over from e-miles, that counts as a partner activity towards a bigger bonus, but those have become exceptionally rare.

Still you can monetize spare time clicking through surveys through miles-earning survey sites.

What Other Ways Do You Earn Miles?

And are there any of these techniques that you aren’t using to earn miles?

Fidelity stopped awarding miles a long time ago. 🙁

some banks offer miles for getting mortgage with them. Great article, Gary, Thanks!

Is there ANYTHING remotely nutritious in that grocery picture???

This is a recycled article. UA flights don’t earn 100% when credited to SQ anymore.

Lyft

United MikeagePlusX app is awesome especially when combined with a United CC. (25% bonus). I almost never fly UA, but I’m happily collecting miles where I would otherwise get none or where I can stack.

I just signed up for Thanks Again. Great article.

does anyone know if the United MikeagePlusX app impacts other earning channels?

It’s just buying gift cards. You can stack them with soipping portaals and also get credit card miles. It doesn’t trigger any of the “not valid with any other offer” stuff.

@Erik, thanks