Marriott had an investor call yesterday to discuss the acquisition of Starwood, and the future outlook for the combined companies.

Naturally the focus is on the deal and their argument for its upside. They’re now arguing that they will achieve $250 million in synergies within two years, for instance.

Total cost synergies have been raised from a pre-tax run-rate figure of $250 million up from $200 million; we expect these synergies to be fully achieved within two years post close

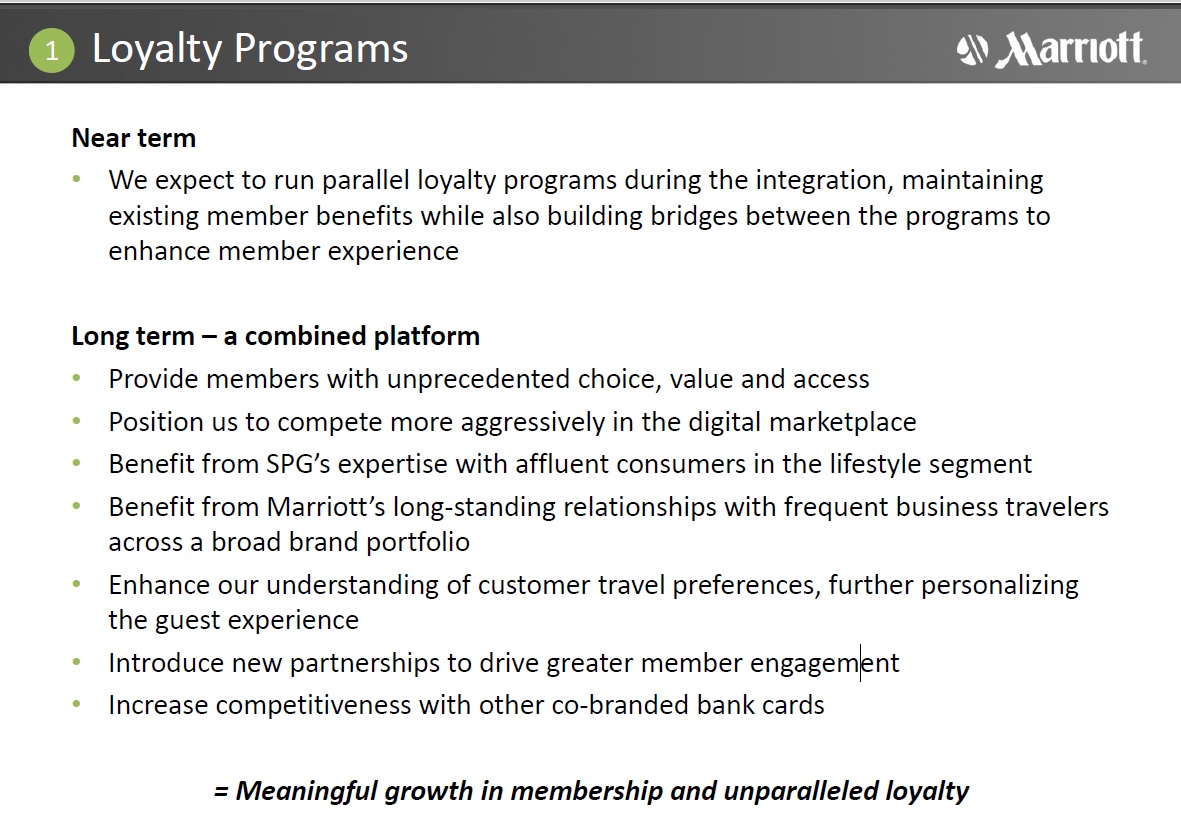

Most interesting to me is that the presentation slide deck included a page on the future of Marriott Rewards and Starwood Preferred Guest.

This is the first time Marriott has publicly stated that Starwood Preferred Guest and Marriott Rewards would be combined. At some level it seems obvious, but since Marriott runs a pseudo-separate Ritz-Carlton Rewards it’s conceivable they could have kept SPG as a separate program (and potentially kept the separate American Express revenue stream).

So SPG remains independent through a transition period, if the merger goes through. My take remains that it must be independent in 2017 at least, since the project to merge the two programs is likely at least 18 months from a data-matching and IT perspective (let alone all of the decisions that still have to be made, since Marriott doesn’t have full, intimate details of SPG’s books yet to understand programs like Your World Rewards and the Starwood-Uber partnership).

It’s interesting that they recognize a need, though, to offer a more competitive co-brand credit card. I like the signup bonus on their card, but earning 1 Marriott point per dollar on unbonused spend doesn’t make sense for most people. It’s just not a rich reward.

Skift summed up much of the call.

- St. Regis brand stays. W stays. Luxury Collection may get folded into Autograph Collection. They’re trying to figure out what to do with AC and Aloft,

We tend to think of AC hotels as being a more of a European lifestyle approach, and Aloft as being a bit more of a western lifestyle approach. We think their customers that are drawn to each of the two as there will be owners and franchisers that are drawn to each of the two

Will Al Maha Desert Resort Join Autograph Collection?

The St. Regis Abu Dhabi Can Stay a St. Regis - Some of the bad Sheratons are going to need to be deflagged.

- Marriott won’t say where the extra $50 million in ‘synergies’ they’re projecting since the deal was first announced came from.

Marriott’s CEO says he believes loyalty will be more important, not less important, for the company in the future. That’s why we should trust him that he wants to make the combined program better, not dilute the value of Starwood’s elite program.

Marriott’s CEO also said though that he doesn’t believe in devaluations which certainly isn’t going to be consistent with the long experience of most Marriott Rewards members. And of course a year ago he also said he wasn’t interested in doing Starwood-type deals.

So we’ll see if the narrative that Marriott will become the only hotel loyalty program you need to belong to will come to fruition.

That is good to hear but not surprising. SPG has much higher end properties and command higher margins, which imply more room to entice customers with perks. Though it seems the programs will merge, i suspect some package of perks will create differing incentives for Westin, Sheraton, Marriott, JW, St Regis, and W customers vs the lower end of the combined portfolio – but they overpaid by a fair amount so who knows if they are smart enough to do so.

I really don’t want to lose my recently-gained-by-AMEX-credit-card right to use Sheraton Lounges. Please keep that right forever.

Probably the best point from the call is that even Marriott realizes the Sheraton flag needs a lot of work. Though I wouldn’t be surprised if they told property owners of some of the dumpier Sheratons that if they just invested a bit of capital for some minor sprucing up, they could fly the newly acquired Delta flag. (Similar to how some of the dumpier Hiltons are going through minor renovations and reflagging as Doubletrees.)

Ugh. Hoping for Chinese re-raise.

Smartly, Marriott is telling SPG that they have many beat up Sheratons. When you stay at a flagship brand of a lodging company, there are certain expectations, and one of which is not to show up to a dark, dumpy, beat up looking hotel.

On earnings via credit-cards, I’m surprised that Chase did not clue them in (or did but were rebutted by Marriott.) It takes 2–3x as many Marriott points to get a free room vs. Hyatt. Of course, money-paid Marriott stays (10–13 pp$) do earn 2x of Hyatt stays(5–6.5 pp$,) so that part is fair. So to compete with the Hyatt Visa, the Marriott Visa (& also the IHG MC, maybe more so) need to offer 2 pp$ on general spend & 4 pp$ at Double Points Merchants!

So the Marriott offer goes from $11.7B to $13.4B and the projected annual savings go from $200M to $250M?

Must be those negative interest rates I have been hearing about.

These guys need to go work for the Feds.

Synergy saving is typically completed by removing redundant functions at the aquire-ee company. For instance, you don’t need 2 HR’s, 2 Marketing Departments, or 2 Payroll’s. Other synergies are completed by combining resources (data, real estate, legal agreements) that give them more bargaining power with partners or consumers.