American Airlines sent out its annual meeting notice and proxy statement this week. The item that’s getting most of the attention is how much CEO Robert Isom makes $31.4 million although that headline number is somewhat misleading.

There’s no question that Isom is well-compensated compared to the airline industry as a whole (and American financially underperforms) and it’s especially controversial among employees when flight attendants haven’t seen a raise since 2019 while first and second-year Boston-based flight attendants qualify for food stamps.

But there’s a lot more in here that matters: Re-election of the Board of Directors; ratification of KPMG as their auditor; non-binding vote on executive pay; allow amendments to bylaws and certificate of incorporation by majority vote; and a vote on a proposal for third party audit of the airline’s ESG goals.

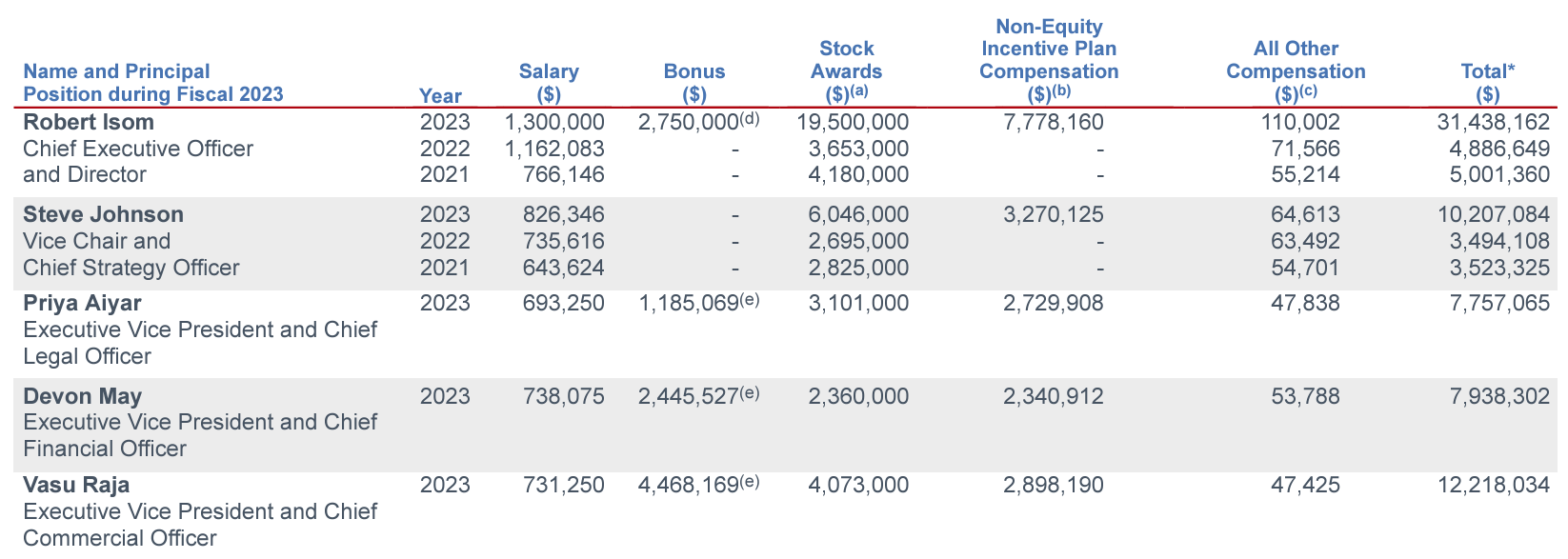

What American Airlines Top Executives Are Paid

Here’s American’s 2023 compensation to named executives. This compensation is set by the board, but shareholders get an advisory (non-binding) vote – an opportunity to say whether they think it’s awesome or off base.

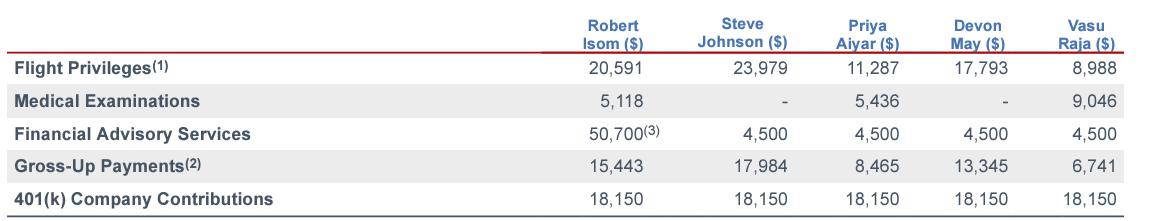

American’s officers don’t just receive salary, bonus, and traditional benefits like health and dental. They and their families receive free travel, lounge access and AAdvantage status and they get travel passes to give away as well – with the airline picking up their tax liability for it.

The positive space flight privileges provided to our officers, including the named executive officers, include unlimited reserved travel in any class of service for the officer and his or her immediate family, including eligible dependent children, for personal purposes. Officers and their immediate families, including eligible dependent children, also have access to our Admirals Club® travel lounges at various airports and have AAdvantage Executive Platinum status. Officers are also eligible for 12 free round-trip passes or 24 free one-way passes each year for reserved travel for non-eligible family members and friends, and we cover the income tax liability related to these flight privileges. Officers are required to pay any international fees and taxes, if applicable. In addition, each of Messrs. Isom, Johnson and May are vested into the foregoing lifetime travel benefits and are entitled to continued receipt of these benefits upon their termination of employment, other than coverage of income tax liability. Mr. Raja is eligible for lifetime space available travel benefits.

Some top executives at the airline do now have non-competes in their employment agreements, something American was burned by in the past when they fired President Scott Kirby, who is now CEO of United and revitalizing that carrier. Isom’s non-compete is for 24 months. Vasu Raja does not have a non-compete.

Walking Away Money And Other Benefits

It’s actually interesting what happens if American Airlines were to be acquired. Isom gets a $23.8 million payout. Vasu Raja gets $4.2 million in that circumstance, and CFO Devon May gets $3.4 million. Isom gets $23.5 million if the board fires him. If he loses his job becaue of an acqusiiton (‘change in control’) he gets $31.9 million.

American Airlines covered the costs Isom incurred negotiating against them for his deal. He spent $46,200 on lawyers negotiating his employment deal, and American picked up the tab. So much for his admonition not to spend a dollar more than the airline needs to on anything.

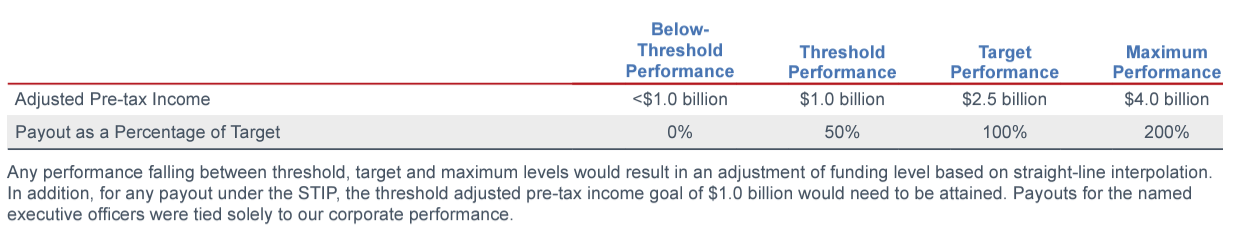

American Sets Its Targets To Reward Executives Too Low

At the airline’s Media and Investor Day in 2017, then-CEO Doug Parker famously declared that the airline would ‘never lose money again.’ His presentation described the airline as being like an annuity. They were, effectively, on autopilot to earn $3 billion to $7 billion per year and would average $5 billion annually into the future. There’s been 20% inflation since then – just saying even should mean $6 billion!

Yet Isom’s compensation package describes $2.5 billion as the airline’s target, with $4 billion net profit as a home run – earning him the greatest possible bonus. As George W. Bush once said the soft bigotry of low expectations.

American’s Board Of Directors Doesn’t Hold Executives Accountable

American Airlines board members receive Directors receive $100,000, plus additional compensation for serving on committees, plus $150,000 in stock.

They also receive complimentary travel for themselves and family members; passes to give out; and ConciergeKey status – and the company covers their tax liability for it. Directors earn lifetime flight benefits based on length of service.

Their job is to set the vision for the company, approve big decisions, and hold executives accountable.

During the pandemic, then-American CEO Doug Parker told employees that the Board lacked airline experience.

[O]ur board – which is a fantastic board – doesn’t have anyone on the board with airline expertise, that has worked for an airline before. That has an impact on their deliberations and their ability to understand.

He shared that at the time American brought former Northwest Airlines CEO Doug Steenland onto its board. Steenland had been Robert Isom’s boss, and so presumably was there to be an ally as Isom prepared to take the reins. Steenland serves on American’s compensation committee.

This is a board that has stuck by management as they’ve alienated shareholders, employees and customers.

- American has made bad investments in other airlines like China Southern (which they wrote down) and Gol (which went into bankruptcy).

- They lost major partnerships (LATAM to Delta). They lost their major play in New York (to an adverse anti-trust ruling).

- The carrier no longer talks about taking care of employees so employees take care of customers in order to earn a revenue premium. Instead, the schedule is the product.

CEO Isom’s mantra has been that reliability is what will make the airline perform, failing to understand that it’s a baseline – it isn’t enough. American has become far more reliable, but not more profitable. Expenses are too high to earn money without a revenue premium.

And failing strategically to secure its position in the biggest spend markets in the country (Northeast and Bay Area/Pacific Northwest), they admitted at Investor Day that they’ve fallen behind both Delta and United in co-brand credit card charge volume when half a dozen years ago they were number one.

The board sets the vision and direction for the business, and this board simply deferred to Doug Parker who led them down an unprofitable path. As CEO of US Airways he cut short American’s bankruptcy process (leaving it less competitive than peers), overpaid for it in order to become CEO of the world’s largest airline, and left it with unprecedented debt, higher costs, and less of an ability to generate revenue from its assets than peers. In other words, the board didn’t do its job.

Does Robert Isom Deserve This Pay?

CEOs of large public companies are well paid. Many CEOs are paid a lot more. Airline CEOs, which tend not to be prized by the market, aren’t among the highest paid in their group.

It’s difficult to assess how much a given CEO is worth. In general, they capture a small amount of the overall value they create. The best ones are worth a tremendous amount to shareholders relative to the median person that might fill the role. At the best companies well-compensated CEOs are probably underpaid.

Robert Isom was named the ‘world’s best airline CEO’ last year so I guess he’s worth quite a lot? Of course that list placed the CEO of China Southern in the top 10 – and American literally wrote down the value of that investment. It also misspelled the name of JetBlue’s CEO and the name of Dubai-based Emirates.

Some of reported compensation is a function of ‘back pay’ that the board feels they owe Isom because he didn’t get raises during the pandemic.

Robert Isom, Vasu Raja, as well as the airline’s CFO and Chief Legal Officer were promoted at a time when the airline was under restrictions as to how much they could compensate their officers. These were contained in the CARES Act, because it would be unseemly for the government to ultimately give American approximately $10 billion and have it go out to executives. But now that those time-based restrictions have lifted, the airline justifies some of their compensation on the basis of not having been able to give it earlier. That feels awkward.

Some of the reported compensation is, effectively, retro pay which is what makes the amount so large and appears larger than what peers receive. The stock compensation is also large because he owned less of American than other CEOs – who have been in place longer! – own of their airlines.

His salary was “set at a level $1.7 million below the last-reported annual target compensation of the CEO of Delta.” Delta’s CEO should be making a lot more than American’s CEO, though, given the relative performance of their businesses.

Robert Isom didn’t really earn $31 million in 2023. He was given a one-time payout to account for not having received a raise while the airline couldn’t do so because of the $10 billion in taxpayer money it received. He also received an unusually large stock grant aimed at bringing him closer to peer CEOs in ownership stake in the airline.

But he probably shouldn’t be paid as much as other CEOs who have performed better. He shouldn’t (yet) own as much of the airline. And the airline has lowered the bar for what is bonusable. Since this is a board that doesn’t hold its executives accountable, this shouldn’t be surprising.

Other Matters

In meeting and proxy materials, American asks shareholders to approve KPMG as its auditor right after a record $25 million for exam cheating by a firm leader and two years after a cheating scandal at the firm involving their Supervisory Chairman. But that’s probably not worse than activity at other large accounting firms? And they aren’t going to go with a small shop.

They want to eliminate supermajority requirements for changes to bylaws and certificate of incorporation, which are meant to protect small shareholders.

And the airline recommends rejecting a shareholder proposal to audit their progress on ESG goals, including DEI. The airline did donate $2.5 million last year to former CEO Doug Parker’s foundation which pursues diversity in the cockpit. So there’s that. And as for climate, I mean, they’re an airline after all.

Ultimately, American Airlines remains perhaps the carrier in the world with the greatest potential to be better than it is today. And they’ve set up compensation to top executives like they’ve already achieved it.

This goes back to a comment I made on a different post by Gary: Many CEOs and business leaders don’t make decisions based on what’s best for their company. They make decisions based on what’s best for them. If it will help me meet a performance goal and get a bigger bonus it’s the “right” decision, regardless if it screws the company down the road. That will be someone else’s problem.

The failure of Boards of Directors to address this is disgusting.

This article finally convinced me that flying AA is a joke. I have miles that I should use, probably will not. And I’m Aadvantage Gold

I 100% agree with you Gary. The AA flight attendants are over paid, especially the ones in Boston. We need to get that corrected so the fares come down. Match comp foe the in flight cocktail waitresses to customer satisfaction. Only then will the in the air magazine reading iPhone staring haters of customers be fairly compensated.

That was the point wasn’t it?

I recently had the following experience with AA after a lovely family vacation. They replaced my bag and gave us a tiny refund for the unused portion of our tickets ($190), but they have not followed up about the hotel expense or, you know, their overwhelming ghastliness. My husband had to drag me away from the woman in a wheelchair with my mouth hanging open.

https://www.linkedin.com/posts/becky-priest-santavicca-755b714a_i-should-have-taken-the-hello-kitty-plane-activity-7177827158176735232-YT9P?utm_source=share&utm_medium=member_android

-The board of directors sets executive compensation, not the CEO.

-Envy is such a noble emotion (meant sarcastically).

-You’ve been the CEO of how many airlines?

You’re always an ultra skeptic of AA, Gary. I still remember about a year ago that you predicted they’d go Chapter 11 soon (which was laughable at the time, and seems just plain stupid now). Are CEOs overpaid? Sure. But so far, Isom has done a good job. He has, for example, made the airplanes run on time. I’m pretty certain he will prove himself an EXCELLENT airline CEO. And your comment today will seem as ridiculous as your bankruptcy comment a year ago.

“He made the trains run on time.”

“He has, for example, made the airplanes run on time.”

Similar?

Congrats, @jns, you got the reference.

But it’s a big deal. He was an operations guy, and he’s done a heck of a job with the operation. Meanwhile, as seems to be the executive culture there, they seem full of good innovative ideas — while keeping an eye on whether they’re profitable. We will have to see how it goes, but NO ONE thinks Isom is off to a bad start.

@ Gary — There are very few people in the world who “deserve” to earn $30 million per year, and Robert Isom isn’t one of them.

@Chopsticks – I did not predict chapter 11. That is simply not true.

In 2020 financial markets were predicting it, but government bailout rescued them.

Later I described a specific scenario where it could happen – where fuel prices were high, the economy was in the recession – American’s costs rose while revenue fell (from tickets as well as card revenue). That has not been the macro scenario in the United States and I did not say that it would be.

Please do not misrepresent me.

@desertghost “-The board of directors sets executive compensation, not the CEO.”

Such wise words I think it is a point made quite clear in this post hence a whole section on this board.

As for envy, I do not wish to trade places with the current CEO of American Airlines !

I wish AA didn’t defer those new widebodies, flew to more long haul destinations, and actually valued Executive Platinum members. It’s actually HARDER to earn these days than before, unless you make $400k a year and/or are allowed to put major company spend on personal credit cards.

A first year associate at Wachtell makes over $400k a year. So do “senior” software engineers at Meta, engagement managers at McKinsey, the list goes on. If you’re not making $400k by age 25, you’re a certifiable loser.

Failure is not career limiting….or unprofitable

Robert Isom enriches himself off the backs of his employees. Flight attendants still work under an expired 2019 contract, some at poverty levels. And let’s not forget the 650+ service recovery employees who were laid off at the end of March in an effort to consolidate and “improve” customer service. Let’s see how that works out. There’s a special place reserved for Isom and his cronies….

@high class professional: making $400k TC by 25 is not possible as a big law lawyer. That’s a 4th year salary (age 28). No one at McKinsey makes that much until they make Jr Partner.

At Meta, it may be possible but requires two promos in 3 years. Even then, equity isn’t high enough to achieve 400k for a couple more years without crazy good stock appreciation. Has happened in the past but job market is way tighter now and promos have slowed.

Tldr, you’re a douche

The part of the story which seems unfair is that 2.5 million was given to Parker (Former CEO) charity while these guys are paid paid millions every year. It could have been better spent by giving each flight attendant 100 bucks as it has been over 5 years without any wage increase. And people wonder why the service is so poor on American Airlines.

Don’t forget about the 650+ that were laid off to Improve customer service by outsourcing to Manila, Port of Spain, and cape-town.

Flight attendants are still waiting on a package for livable wages, and some qualifying for

FOOD STAMPS.

I’m baffled that a company who reported record profits can get away with this.

Isom getting “back wages” while employees also went without pay, or profit sharing.

What a joke of an airline.

Waiting to see how this plays out for them.

@Mdtravel and what’s your point?

Baseless information you have provided! But thanks for amazing observations!!!

Lmao

With a huge dep ,paying a fortune every month to the pilots ,now is going to star the mechanics new contract negotiation ,old planes folling apart ,and all the others employees without a raise for 5 years I can not see a future for AA ,only brankropcy !!!good luck AA ,and nobody knows why the service with AA is so horrible!!!!is because nobody cares!!!

Well AA is a very large company but I struggle with a CEO comp package of >$30MM that I don’t see matched by performance, esp. for its shareholders, of which I am glad I am not one.

I do have opinions on corporate governance, having been deeply involved in it. A lot of AAL’s issues stem from having pretty worthless Chairmen, IMO, esp. the current incumbent who may be a nice guy and a fantastic financial engineer, but otherwise, not so useful. I was never joking when I used to opine that Akbar Al Baker would make a great Chairman for AAL. He certainly wouldn’t be pushed around by the CEO.

AAL also needs a strong Comp Committee Chair. IME, too many comp committees jut look for the “right” consultant’s review and report so they can support whatever plans they put in place if they get sued for it.

In closing, it would be interested to know what if any conditions have to be met for Isom to get his share grants.

IMO- Being a CEO of a very large company (and even a small one, say 200 employees) is a bit more difficult than most people think? I mean, you are always available. Yeah- you go on vacation but you are checking email while your kid makes their first cannonball in the pool.

You are on a business trip when you son gets his first hit.

You are on a conference call when your daughter pulls out a tooth- by herself.

You are awake every day at 3am talking with suppliers from China because of a QA problem that has to be fixed in days, not weeks.

You are at the beck and call of a board who says the board meeting in July (where you are supposed to be on vacation with family) is being rescheduled the week before (The Board’s Secretary has one job- and that is to make the schedule and decide the agenda… and guess what, if it’s not on the agenda, it doesn’t get decided… it’s actually a balance of power between the Pres/VP, Treasurer, Secretary)

And you make $1mm or more. And make even more.

But then you turn 55 and your kids are estranged, but you still have your other CEO friend group you hang out with in Jackson Hole, Miami, Park City, and Hawaii.

Yes- I think it’s worth $32 MM to put up with these losses, IMHO.

-Jon

No board member will ever vote down an outrageous package for an executive. It’s a club and they all take care of each other (and their spawns with “internships”)

@Jon…. Isn’t that description applicable to a whole lot of lower paying positions in the work force, not just the poor guy or gal forced to be a CEO of a large company? Speaking of airlines and using your impression, all flight crew members would qualify for extraordinary incomes, especially those away from their children’s first day off to school, their first Christmas, first birthday, first ballet recital, etc. etc,

Not to mention all the workers involved in travel for work and those of 24/7/365 operations.

Heck, American business culture expects employees to read emails and stay up-to-date with their employee WHILE on “vacation”… supposedly the time to be free from work!!

American Airlines has placed orders for hundreds of narrow-bodied aircraft and no new orders for wide body aircraft. With Isom’s comments that customers only care about reliability (on-time operation) and nothing else, it appears that he wants the airline to become the nation’s discount “bus service” in the air, offering a domestic route system to smother the other low cost airlines, while offering very little in other services to customers other than a drink and either pretzels or Bischoff cookies served by employees skimming the food stamp threshold. Delta and United can be the premium airlines with an impressive international operations supported by their domestic operations. AA will maintain enough of an international operation to have seats available in premium cabins to maintain their high dollar customers. Note that planning for future aircraft and refurbishment includes much larger premium cabin seating to accommodate those precious customers. It’s a plan that may have merit. Time will tell!

Maxine is correct in indicating the BOD and senior corporate management goes like it does: too much back-scratching and go along to get along behavior. And, yes, a lot of the plum internships for the spawn of the more privileged is based on who you know rather than on what you know and other social associations the spawn have. We are a country of affirmative action for the rich and well-connected while people whined like crazy about affirmative action for visible ethnic minorities and women.

About a 25-year old WLRK associate making $400k in 2024? There aren’t going to be many of them — which should be rather obvious to even the relatively ignorant, especially given the firm size/dynamic and that typically we are talking about 4 years of college + 3 years of law school and then starting work as a lawyer after graduation from law school. And that college+law school process doesn’t start earlier than 17 or 18 years of age for most of the part of the American population that goes to law school.

Highly unimpressed by “high class professional”. He should go back to his stuffed animals and bitcoin games to try to impress the easily impressed.

Yet @Mdtravel wonders why the flight attendants act the way they do. With passengers like that…