A month after announcing a new rewards checking account American Express is surveying a new business checking account that’s potentially more lucrative.

Credit Cards

Category Archives for Credit Cards.

How Much Money Do Amex Platinum And Centurion Cardmembers Make?

Most premium Amex customers live in New York city – more than double the number in second city LA. And, it appears, on average they make quite a lot of money even though I’ve nott found it difficult for readers without such high incomes to get approved for Platinum cards.

Whoa: Chase Isn’t Just Improving IHG Card Benefits, They’re Bumping The Up Front Bonus Too

Earlier I wrote about how Chase is seriously improving the IHG® Rewards Club Premier Credit Card.

It turns out that the card isn’t just adding new benefits. They’ve substantially increased the up front bonus, as well.

Capital One Running Three Mileage Transfer Bonuses: LifeMiles, Wyndham And Aeromexico

Wyndham can be useful for home rental stays (generally 15,000 points per bedroom per night). Aeromexico is limited use, but there are some use cases. The most useful promotion here is with LifeMiles – reasonable award chart, no fuel surcharges, and awards across Star Alliance.

Capital One Adds Virgin Red As New Mileage Transfer Partner

Capital One is adding a new 1:1 mileage transfer partner “in the coming weeks.” Virgin Red.

Chase, American Express, Citi and Bilt all transfer to Virgin Atlantic. Virgin Red is the multibrand Virgin loyalty currency that includes Virgin Atlantic. So this gives Capital One Virgin, too, while also allowing them to say they’re “the first US credit card issuer to partner with Virgin Red.”

Restaurant Group CEO Earned 9 Million Amex Points Sending Company Funds To Son’s Paypal Account

The CEO of restaurant chains Fatburger, Round Table Pizza and Johnny Rockets has been under federal investigation for tax evasion. Agents raided the home of his daughter-in-law, whose mother is “Real Housewives of Beverly Hills” star Kim Richards (his son and daughter’s wedding was a plot line in the Bravo show).

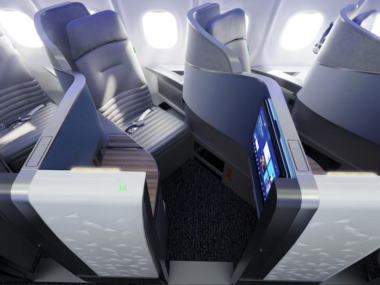

A New Co-Brand Credit Card May Be Coming That Awards You Ownership In The Airline

During the pandemic credit card companies weren’t adding many new customers for travel credit cards. But customers were still cancelling cards, at least at normal rates. (Banks went to great lengths to retain customers and did stop greater levels of cancellations in most cases.)

But without adding customers to the funnel, portfolios shrank. That’s a major reason we’ve seen such big initial bonuses over the past 6-9 months. And we’ve also been seeing cards get refreshed with new benefits, to remain competitive, to better appeal to new customers, and to address customer preferences that have changed.

New No Annual Fee 4x Restaurants & Gas Card Has $300 Initial Bonus Offer

Honestly I had to look up what sport the Pelicans played (basketball) but this card is really good for 4% back in a popular earn category without an annual fee.

American Express Launched No Fee Mileage-Earning Debit Card (Huge)

American Express just announced ‘Rewards Checking’ for U.S. credit card customers. It has no account fees or minimum balances, pays half a percent annual yield on balances, and comes with a points-earning debit card (1 Membership Rewards point per $2 spend). I expect this will be my go-to for tax payments.

Spark Cash Plus $3000 Initial Bonus Offer

Capital One discontinued their highly popular Spark Cash card for new business cardmembers over the summer, and at the same time introduced Spark Cash Plus as a 2% cash back card with a $150 annual fee.

A $3000 initial bonus offer with high spend requirement will certainly be attractive to many high spenders. Of course that’s exactly who they’re looking for with this offer!