Chase created Chase Dining with Tock offering special restaurant reservations at top places set aside for cardmembers. This was part of a continued assault on American Express as the category leader in travel and entertainment. Amex, by the way, didn’t stand still. They traditionally offered a special reservations program but double down by acquiring reservations platform Resy. The American Express Gold is my favorite card for dining spend, earning 4 Membership Rewards points per dollar. Chase’s premium Chase Sapphire Reserve® has offered 3 Ultimate Rewards points per dollar since card launch. Recently Chase revamped its Sapphire cards and made them even more rewarding on dining. The $95 annual fee Chase Sapphire Preferred® Card improved its earning to 3 points per dollar on restaurant spend, and added a getting a 10% anniversary bonus on spend during…

Credit Cards

Category Archives for Credit Cards.

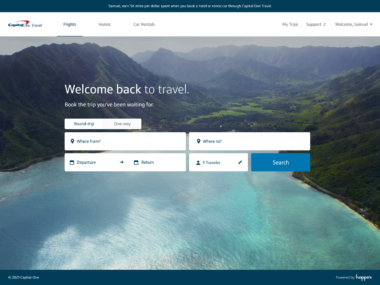

Capital One Reveals New Best Place To Book Airfare, Save An Average Of 15%

Capital One made a $170 million investment in Hopper, the online booking service which uses machine learning to guide customers on when it’s the best time to buy a plane ticket. And they’re partnered with Hopper to roll out their new online travel tool which will layer Hopper’s prediction analytics with guarantees for the traveler. They’re offering the most guarantees of any places customers might book online – all while letting them use their points to pay for travel if they wish.

Chase Backtracks On Cancelling General Flynn’s Wife’s Credit Cards Over “Reputation RIsk”

General Michael Flynn posted a letter to his social media account showing accounts being closed by Chase next month due to ‘reputational risk’. There was one thing odd about the letter – the first name it was addressed to had been blacked out. It turns out Flynn’s credit cards weren’t cancelled. It was his wife’s accounts being closed. And, amidst a backlash, Chase is re-opening them.

Can’t Last: New United Card 100,000 Mile Bonus Offer

The new United QuestSM Card has launched with a temporary offer of up to 100,000 bonus miles. And it’s intriguing for its annual United Airlines statement credit and award redemption rebates.

American Express Looking At Options For $650 Annual Fee Marriott Card

Back in December I broke the news that American Express was looking at making substantial changes to their premium Marriott co-brand card. There was talk of a $650 fee (or more) to go along with better points-earning, waived resort fees, and even confirmed suite upgrades.

American Express is now surveying a more specific product, that appears to be taking shape.

Two No-Annual Fee Cards Offering 100,000 Points / Up To 10% Back For A Year

New rewards credit card company Cardless has some strong new products, including one of the best no annual fee cards in the market. And now may be the best time to get two of their cards, because of a new offer that lets you earn up to 100,000 bonus points in your first year – indeed this amounts to earning up to 10% back on your spending for a year.

The End of Magnetic Stripes On Credit Cards Is Coming

Credit cards no longer have to have raised numbers on them. Starting in 2024 Mastercards will no longer have to have magnetic stripes, either, and no new Mastercards will have them after 2029.

Capital One’s Strategic Small Business Shift: Finance Small Players, Reward Big Ones

Capital One is discontinuing the highly popular Spark Cash card for new business cardmembers, and instead segmenting their market into two different products. They seem to want to reward high spenders more, while getting out of the financing game for those businesses, and seeking more revolve from lower-spend businesses.

[Updates].: Curve Will Offer Cash Back Plus The Rewards You Already Earn On Your Cards

They have an interesting model: you load your current rewards card into their app, and then when you use their card you earn the rewards you would earn anyway plus an additional 1% cash back on top for six months by joining the waitlist. They even say they’ll let you move charges you’ve already made in the past between credit cards.

Uber Visa Being Discontinued, Shows How Uber Gave Up On Its Vision Of World Domination

The Uber credit card was supposed to be the centerpiece of Uber’s strategy to build its own currency, Uber credits, which would become ubiquitous as a payment system not just for Uber products but outside of the Uber ecosystem. The primary way these credits would be generated would be through the co-brand credit card, and they’d hopefully become spendable everywhere at retail.

Just as the refresh was reaching the finish line, Uber laid off a large portion of its marketing staff, including people responsible for the card.